In the highly competitive online insurance marketplace, having an effective insurance agency website is the foundation of any digital marketing strategy.

Your customers come to you because of your expertise in the complicated field of insurance. Likewise, digital marketing is a complicated field, and the internet is constantly evolving. It takes a great deal of training and ongoing education to become an expert in insurance or digital marketing. Every insurance agency needs an effective website that stands out from the competition and generates leads to successfully compete online. This ultimate guide is a roadmap to help you understand what it takes to have a successful insurance agency website.

Overview

From website design to lead generation, you’ll find everything your agency needs to succeed with your website in this ultimate guide. Read through the full article, or jump ahead to the content you’re most interested in by clicking the section names below.

- Part 1 – What Are the Goals for Your Agency Website?

- Part 2 – What Are Essential Attributes of a Successful Insurance Agency Website?

- Part 3 – How Does Your Agency Website Fit Into Your SEO Strategy?

Part 1 – What Are the Goals for Your Agency Website?

Key Takeaways

- Determine what you want your website to accomplish.

- Your website should capture your agency’s unique brand.

- Insurance marketing professionals can ensure your website speaks to your audience.

First and foremost, you need to define the goals of your agency website. After all, if you don’t know what you’re trying to accomplish, you won’t be able to gauge the success of your website.

What does your website need to achieve in order to improve the performance of your agency? Are you trying to generate leads? Establish your agency as an expert insurance advisor in the community? Target a specific insurance niche? Differentiate your agency’s brand in the crowded insurance marketplace? How will you measure the overall success of your website?

The best approach to reach your goals is to work with a professional digital marketing provider with experience and expertise in the insurance industry. Insurance marketing experts can ensure you receive a beautiful agency website that reflects your agency’s unique brand, speaks directly to your target audience’s insurance needs, and fits into your overall digital marketing strategy. On the contrary, when you work with a digital marketing provider that doesn’t understand insurance, you’ll spend a lot of time and energy helping them understand your business, and you’ll need to be more involved with the project.

Part 2 – What Are Essential Attributes of a Successful Insurance Agency Website?

If you are still considering which digital marketing company to provide your insurance agency website, it’s important to know what makes a successful website. As an agency owner or person responsible for marketing at your agency, you should know what attributes are necessary to succeed.

Generally, a great insurance agency website will:

- Provide Memorable Branding

- Build Trust & Reputation

- Offer a Positive User Experience

- Be Optimized For Search Engines

- Generate Leads

- Help You Sell Insurance

- Help You Service Policyholders

We will expand on each of these attributes below.

Memorable Branding

With so many agencies in the highly competitive insurance marketplace, it can be very difficult to stand out. However, memorable branding can set you apart from other insurance agencies in your local market.

Your branding is more than just a logo on your website. Your brand also includes your agency name, domain name, slogan, specialties, social media, photos, graphic elements, as well as content style and tone. Basically, everything that is associated with your agency can be considered part of your branding.

Domain Name

One of the first steps to getting started with a website for your insurance agency is to purchase a domain name or web address. While this may seem like an easy task, it can be difficult if you can’t think of a good name or if your first choices aren’t available.

Keep it short and simple, while also avoiding hyphens. This is key to making your domain name address easy to understand and remember. Keeping it short means 15 characters or less, not including the top-level domain (TLD), which is the section of your domain name that comes after the final dot; i.e., .com, .net, .insure, etc.

When it comes to selecting a TLD for your domain name, it’s generally recommended to use .com. It’s the most popular TLD used (see chart below), which means it will be the easiest for your policyholders and prospects to remember. In fact, a GrowthBadger study found that 33% of .com domains are more memorable. It has also been reported that other less common TLDs can be seen by consumers as spammy, reducing their likelihood to click on and trust those links.

Most Popular Top-Level Domains Worldwide (December 2023)

A good domain name is also easy to pronounce and intuitive to spell. If your domain name is easily spoken, then a person’s brain remembers the words and positively associates them much easier. So, if a potential customer can’t say your domain name easily, they probably won’t remember it, and any branding opportunity is lost.

Lastly, don’t keyword stuff your domain name because you think you will rank better in Google. This is an outdated tactic that should be avoided today. If a keyword fits your branding or agency name, like “insurance” or “insuring”, then use it. Otherwise, stick to your agency’s name as the domain name and let the content on your insurance agency website pages mention important keywords that are relevant to your brand.

Logo Design

It almost goes without saying that a company’s logo and website should work well together. Even an amazing agency website will fall short of its full potential without a professionally designed logo.

Your logo is your agency’s brand image that needs to resonate with people, helping to build trust and making them feel comfortable doing business with you.

HubSpot lists 7 principles of logo design:

- Simplicity: A logo should have a clean and simple design, as fine details can be easily lost when resized or placed on different online channels and/or marketing materials.

- Memorability: It should be easy to recall, even if someone only briefly glances at it.

- Originality: Stand apart from your competitors by avoiding common industry colors, patterns, or images.

- Modern Yet Timeless: Not just following a trend or fad, a logo should define your agency’s character while using modern design elements, colors, and typefaces.

- Balance: Take proportion and symmetry into account for a pleasant, balanced logo design.

- Complementary: The logo design and the typeface used for your agency’s name should be consistent in color and design look (i.e., if your design is simple and smooth, use a similar sans serif font).

- Versatility: Your logo will be used in a number of ways on a number of mediums. Ensure your final logo will look just as good on a website as it will on a billboard advertisement.

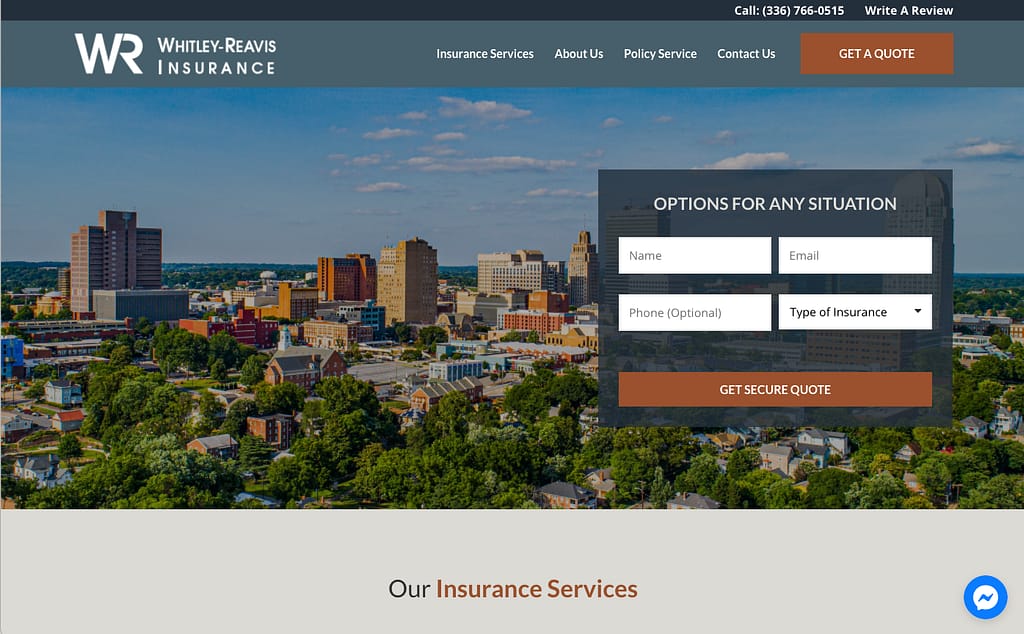

Localization

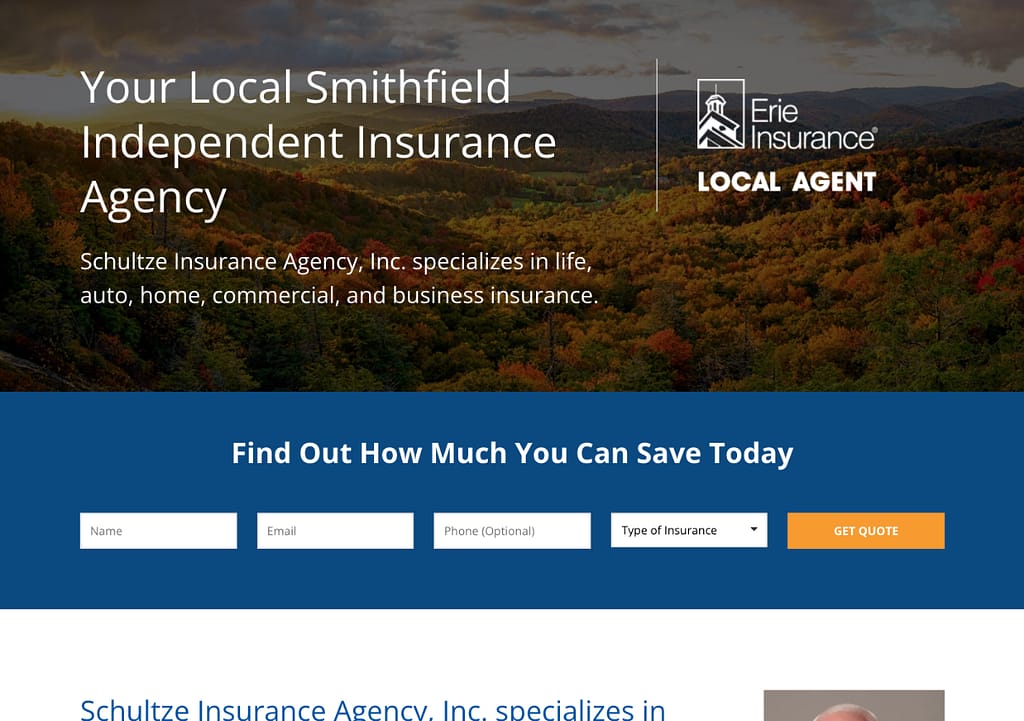

Consumers today are gravitating toward companies that make them feel like they’re being heard and understood. One effective method agencies can utilize to best meet these standards is localization, which entails adapting your website’s look and feel according to the specific cultural and geographical context or preferences of your service area’s target market. This can include mentioning local landmarks, holidays, or events, as well as changing the tone of your content to better reflect that of your desired audience. The localization of website content drives engagement and builds relationships by appealing to the fact that you are a locally-owned business.

Without proper guidance and tools, you could end up wasting a lot of your time and money trying to compete against giant companies online. When you understand how to leverage local insurance marketing tactics, you increase your chances of successfully ranking against bigger national competitors.

Add your city, state, and/or region throughout your website to reinforce your agency as a trusted local resource. Only include this information where it makes sense so it never looks like content was written artificially for search engines, therein jeopardizing user experience.

We also encourage you to use local photography, such as skylines, landmarks, or other easily identifiable places to help you tell your story and localize your insurance agency.

By providing customers with a highly personalized, local experience on your website, you’re making an emotional connection with them and showing them that you are a part of their community.

Staff Directory with Contact Information, Photos, and Bios

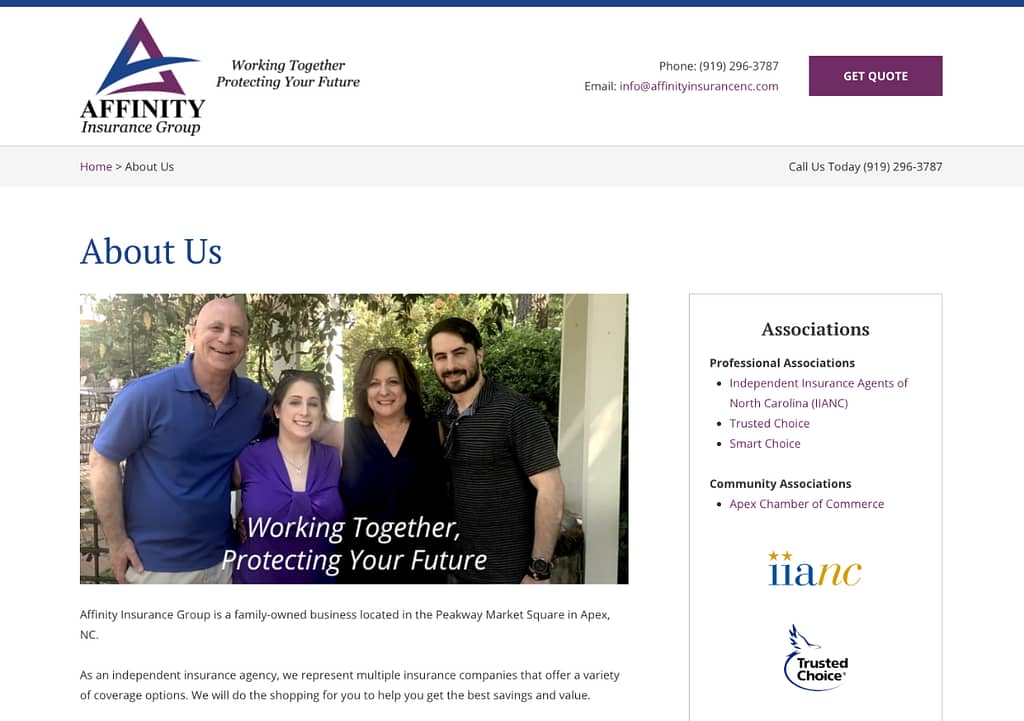

Human faces build trust and increase conversion rates. Your agency website should not only include a “Meet the Team” or an “About Us” page but also include your staff members and friendly bios.

Ideally, each staff member on your website should have a high-quality photo and a bio highlighting their professional accomplishments, designations, and some interesting personal anecdotes. Incorporating this attribute into your agency website will significantly help humanize your insurance agency and brand.

If a policyholder contacts you to make a claim due to an accident, a disaster, or a death in the family, they want to know that someone is going to be empathetic on the other end. They don’t want to talk to someone halfway around the world. Instead, they want someone who knows and understands their needs – someone they have seen before.

Make this connection easy by simply adding staff photos to your website, so people know who they’ll be interacting with. It’s so much easier for your website visitors to trust and connect with real people rather than just a brand.

Social Media Integration

Social media is here to stay, and integrating your social media channels with your website is a must. Social media should be treated as an additional communication channel for your agency. It’s a way of extending your online presence beyond your website. There are a couple of ways to integrate social media with your website.

The first, and most common, is to offer opportunities for your website visitors to follow your agency on social media by adding the icons and links to each channel your agency is active on in the footer of your website. This benefits both your agency and your visitors in a number of ways.

For your agency, this can increase your follower counts and support your efforts to build stronger connections with your prospects and customers. That’s because social media allows you to show the human side of your agency in a fun, casual way.

Your website visitors benefit from this as well because your social media links provide a way for them to take a small first step to connect with your agency, even if they aren’t quite ready to fill out a form on your website or purchase a policy. Because your social media posts should incorporate and link to quality content published on your web pages and blog posts, new followers that came from your website (and really any of your followers for that matter) will always be informed of your agency’s latest announcements and helpful blogs as your social media posts show up on their newsfeeds.

Another way to integrate social media with your website is to create a website chat that is linked to your Facebook messenger account. We’ll touch on this feature more in a later section of this ultimate guide, but having live chat on your website is a great way to greet and engage your website visitors, answer any questions they may have, and generate new leads.

Trust & Reputation

In the insurance business, before a person will do business with you, they must trust you. They need to know you are reputable, can give knowledgeable insurance advice, and can rely on you to help them during a claim.

Different people determine trust in different ways. For example, some may be influenced by your agency’s years of experience or if you have a physical location. Others may get a strong impression of your agency if you work with several well-known insurance carriers. Therefore, your website will need to provide the different types of trust signals that are needed by different consumers. More examples of effective trust signals include professional website design, photos of your office and staff, online reviews, membership with professional associations, industry certifications, awards, and website data security.

Professional Website Design

The design of your agency website needs to be visually appealing while communicating credibility and trustworthiness.

Research shows that users judge a website in a matter of seconds, and your website design and branding make the first impression. A professionally designed website greets visitors with a clean and simple layout that provides a clear path to the most important information.

People don’t trust poorly designed websites, especially if it is for a professional advisor like an insurance agent. If they see a poor design or the information looks outdated, they won’t trust your website or your agency.

A professional, modern website signals trust with consumers. It helps potential customers feel comfortable communicating with you online and puts them at ease to provide you with their personal information.

Highlight Your Experience

Tell your agency’s story. If you have been around for a long time, make sure you emphasize your stability. This will go a long way in building trust. If you are a new insurance agency, highlight any past experiences that relate to your agency.

If your insurance agency is a family-owned or veteran-owned business, showcase that history. Your story is what makes you different from your competitors. People like doing business with people they know and can relate to.

Showcase Your Insurance Carriers

Highlighting well-known insurance carriers works to build trust by reducing the perceived risk of working with your agency – a business they may not be as familiar with as a national insurance brand.

You should feature your insurance carriers on your homepage and build a dedicated “Our Insurance Companies” page showing all the carriers you have access to.

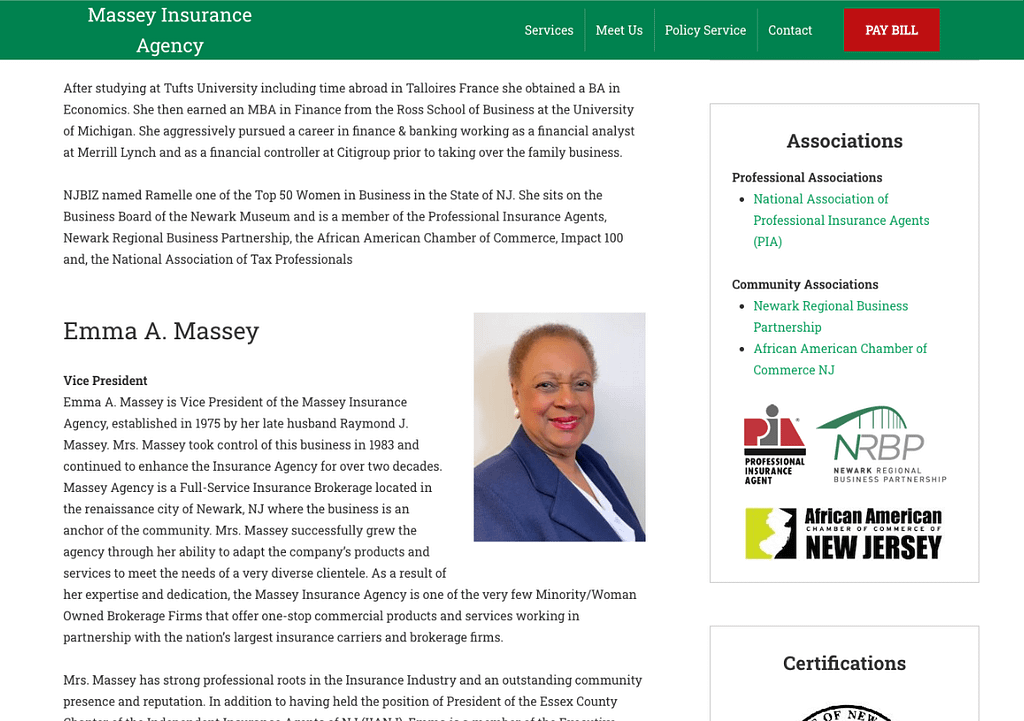

Professional Associations

Establish credibility with logos from insurance industry associations like the IIABA or PIA, as well as local business organizations like the Better Business Bureau or Chamber of Commerce. This communicates to the consumer that you are a trusted business and shows you that you operate in ways that meet industry standards.

Industry Certifications

Build your reputation by showcasing your staff members’ specialized skills or certifications. Having authority and expertise in the insurance field is yet another mark of trust. Showing off certifications, accreditations, and insurance industry memberships help to prove you’re experienced and accomplished.

For insurance agents, adding a CPCU or CIC after your name certainly can help build trust and credibility. These types of credentials are important because they are given out by an unbiased third party and carry more weight than your word alone.

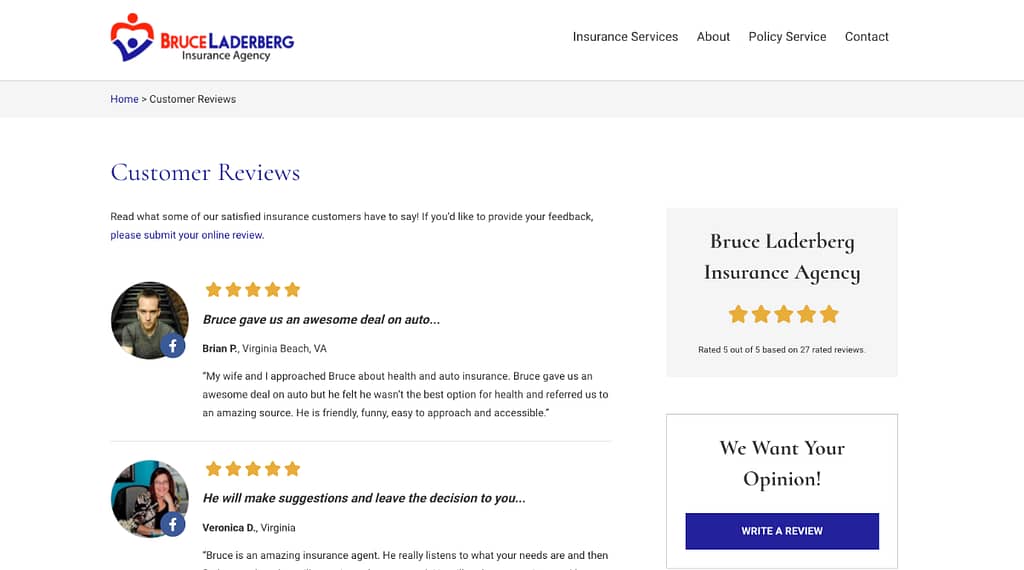

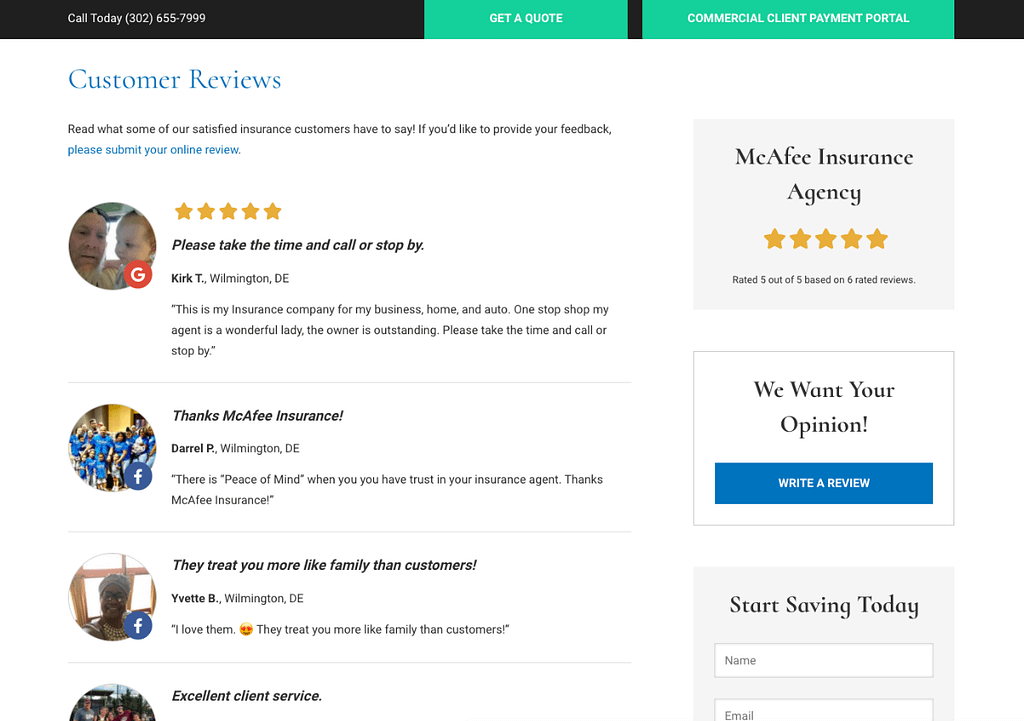

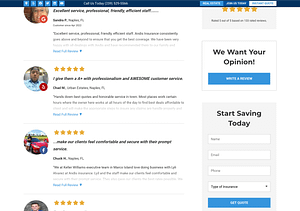

Social Proof With Online Reviews

Social proof is the idea that consumers will adapt their behavior according to what other people are doing or saying.

In today’s digital media age, online customer reviews have emerged as one of the most potent forms of social proof. People take positive reviews and high ratings as social proof that a product or service is worth the purchase.

95% of consumers now read reviews before making a purchasing decision. For local businesses like insurance agencies, 73% of people directly state that reviews increase trust.

Sources: Global Newswire, Finances Online

Therefore, online reviews are one of the most valuable pieces of content you can have across your entire website to build trust. People will always want to know the experience previous customers had with your business and will read your customer reviews. Featuring your best reviews throughout your website will show that your insurance agency has a long history of success and great service.

Also, don’t just copy the review text from Yelp, Google, or Facebook to your website. To further build trust in the website and in the reviews themselves, you should also transfer the photo of the reviewer and the name of the third-party review service from which the review was originally posted. Below is an example of a reviews page with this information that BrightFire implements on our client’s insurance agency websites.

Show Data Security

Security means providing visitors with the confidence that your website is safe to browse. You may know your website is secure, but don’t assume visitors do. Additionally, the frequency of website security breaches, hacks, and lost data reported on in news media means the issue of security is more important than ever to your visitors.

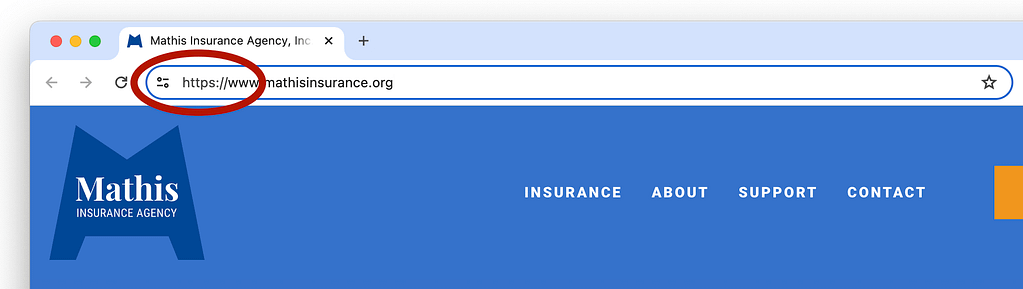

You’ve probably noticed when looking at the URL or web address displayed at the top of a browser that some websites start with “http” and some with “https.” The “s” stands for “secure” and it comes from securing your website with an SSL certificate for data encryption. Websites with “https” have an additional layer of protection for any sensitive data that is exchanged.

Most people expect financial-related industries like insurance to have an “https” URL on their website since this helps to assure customers that it is safe to provide their personal information. It encourages people to trust your brand, even if they are only providing their contact information for an insurance quote.

Display Your Privacy Policy

Many privacy laws throughout the country dictate that if a website collects personal information, it needs to have a clearly posted privacy policy. The California Online Privacy Protection Act (CalOPPA) requires you to “conspicuously post a privacy policy on your website”.

In addition to mitigating any legal issues, a privacy policy helps you build trust with your website visitors. People expect to see a privacy policy on every website. If they don’t see one, they may wonder why it’s not there and assume that your agency is not up-to-date or compliant with current privacy practices.

Providing your customers with a clear picture of why and how you process their personal data makes your customers feel secure doing business with your agency.

Ensure Your Website Is ADA Accessible

Another important way to build trust and improve your reputation is to make your agency website more accessible with respect to ADA (Americans with Disabilities Act) compliance. You can gain a good reputation from users with accessibility issues because you will become more valuable to them. It’s important to note that your new website users may have tried your competitors and been disappointed due to the poor accessibility of their website.

Having an insurance agency website that takes accessibility seriously lets your customers know that you value all people and builds on your social responsibility. For a deeper understanding of how to make sure your website is ADA compliant, view our 20 Minute Marketing Webinar on-demand.

Web Design & User Experience

User experience is how the user feels when navigating through a website and how they respond, whether emotionally or with actions (i.e., leaving your website, making a purchase, requesting a quote). The way a user interacts with your website will help determine if they will take the intended action your website was designed to encourage.

A website’s user experience is based on a responsive web design, custom website design, intuitive navigation, fast website and page loading speed, helpful insurance content, clear calls to action to connect with your agency, facilitating common requests, and active helpful blog content.

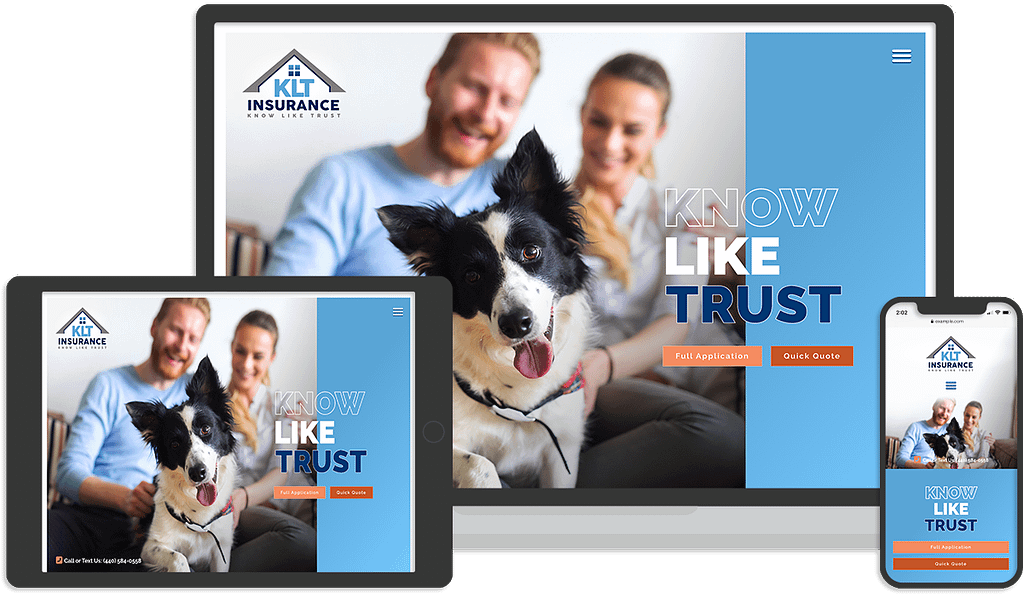

Responsive Web Design

It’s no secret that more and more people are accessing the Internet using their mobile devices in addition to or in place of desktop computers. In fact, mobile phone usage to access the Internet reached an all-time high at the end of 2023.

Internet users worldwide spent 57.6% of their time browsing the internet via mobile phones.

Source: Statista

That’s why having a responsive web design that is equally favorable for both desktop and mobile users is so important.Regardless of the device, if a site uses a responsive design, the images and content will automatically adjust without distorting images or cutting off content. Responsive design champions having one site and one set of content for all audiences instead of outdated approaches such as having a desktop and mobile site that are vastly different. This makes sure that all the different users accessing your website using different devices get a seamless user experience.

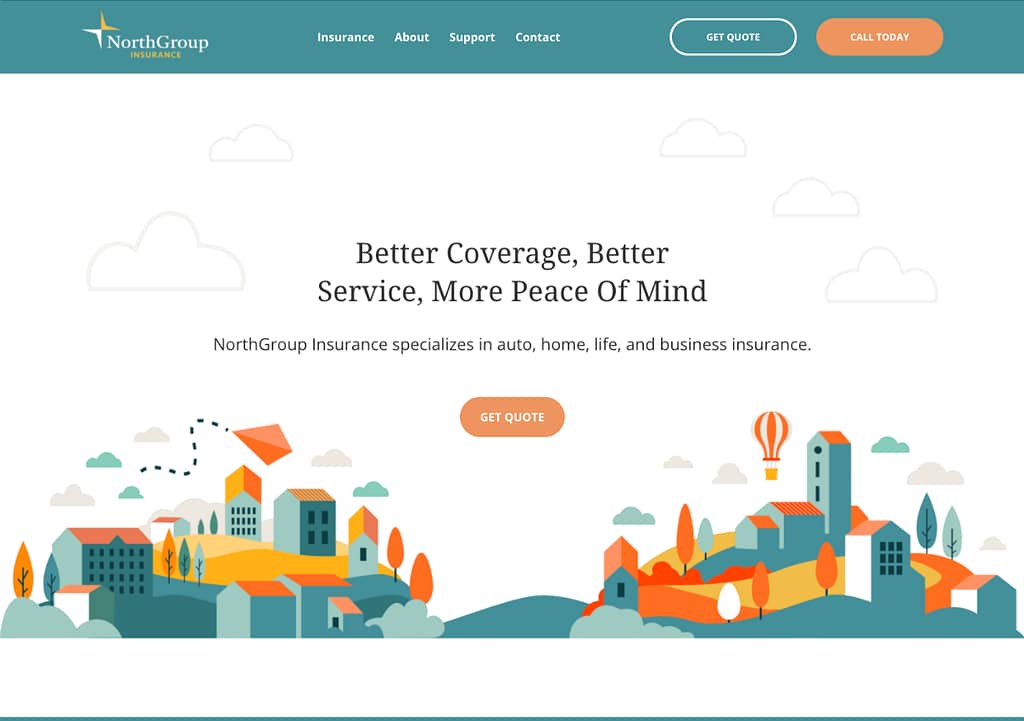

Custom Website Design

Website design includes all the visual components of a website, such as text styles, layout, colors, graphics, and more. But, custom website design includes so much more than that. Having a custom-designed website means being able to create a website user experience that is unique to your agency. This allows a digital marketing company to tailor the design and functionality of the website to how the agency operates.

Pre-built website templates require less time to build and can be a cheaper option in the short term, but they make standing out from the competition much harder. Additionally, they limit your ability to effectively capture your agency’s personality and provide a user experience that is cohesive with how you run your agency.

Custom-designed insurance agency websites capture unique brand identities, provide a superior user experience, generate more leads, and convert more prospects into customers.

Copywriting & Fresh Content

The content on your agency website should be informative and help visitors better understand your insurance services. It also needs to emphasize relevant keywords that consumers use when shopping for insurance online.

Additionally, a static website without new, updated content is considered a stale entity by search engines. When you frequently update your website with fresh content, it acts as a source of new information for search engines. Search engines are more likely to rank your site higher if you regularly update your website with fresh content.

The average person spends only 54 seconds reading your content (Contentsquare). This means you don’t have a lot of time to convince them to trust you and contact your agency for a quote. Thus, it is vital that the content you provide is of high quality and accurate.

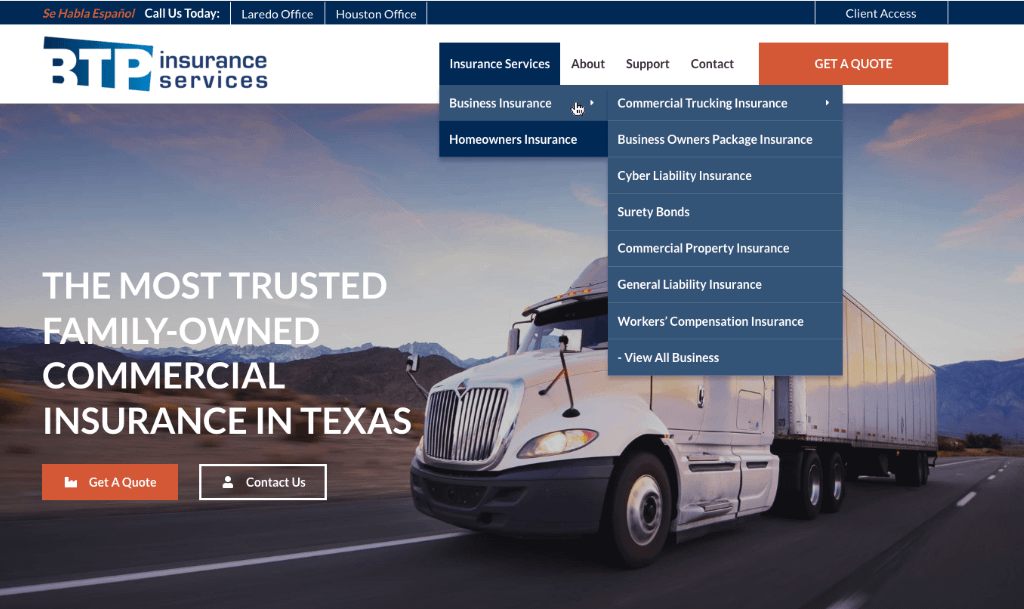

Intuitive Navigation

Intuitive website navigation is one of the most important elements of any website. After all, it’s how visitors find their way around your website. No one wants to hunt for information they need. Insurance coverage pages, for example, shouldn’t be buried five pages deep, but rather, they should be easily located in a service dropdown on the navigation menu.

Making it easy for website visitors to find what they are looking for will make for a pleasant user experience, which will drive better conversion rates and increased lead generation.

Fast Website Speed

The speed of your website matters more than ever right now. As mobile device usage continues to surge, Google now considers page load speed as one of the most important factors in determining your search ranking. It’s also a key component in creating a stellar user experience.

First, faster load times make for a much better user experience. The longer it takes your website to load, the more likely it is that visitors will become frustrated, leave, and browse another site.

Second, conversion rates and page load times are directly correlated. The faster your website loads, the more likely it is that you’ll convert visitors to leads, and leads to customers.

Helpful Insurance Content

If your website does not include the content that insurance consumers are looking for, they won’t stay on your website for long. To ensure your website content makes a positive impact on your audience, include the following types of content:

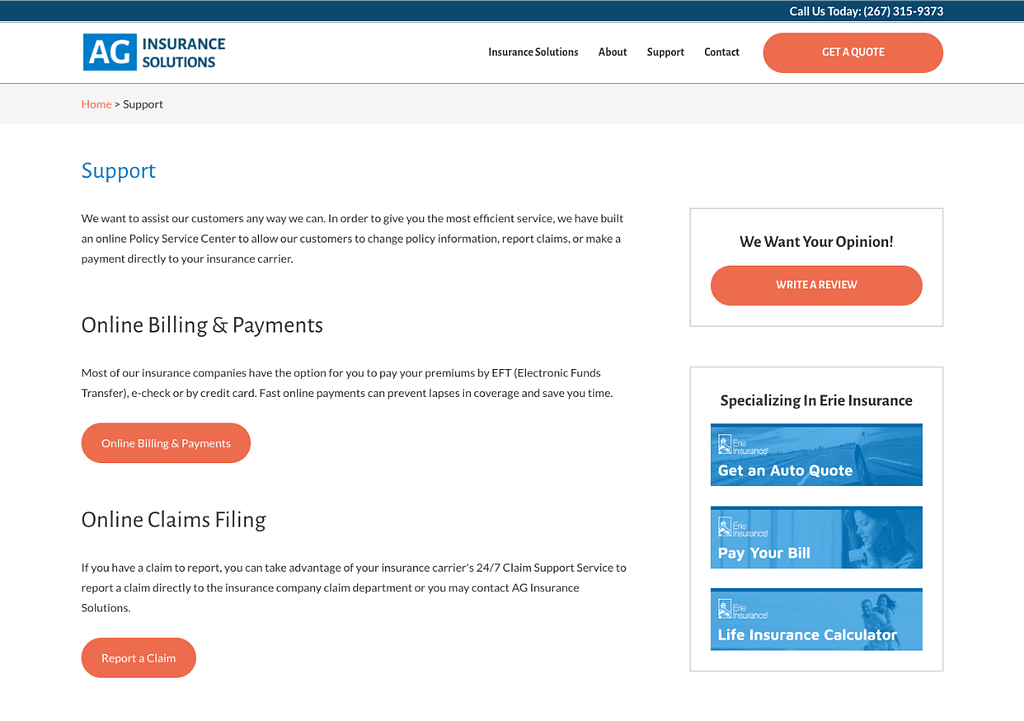

- Policy Service Center: Your Policy Service Center should include carrier contact information and links to make a payment, file a claim, or login to the policyholder’s account.

- Carrier Information: Help your policyholders and website visitors easily identify the carriers your agency works with.

- About Your Agency: Going back to the need to build trust and credibility on your website, you should have a page dedicated to sharing information about your agency. Where are you located? How long has your agency been around? Why should they hire your insurance agency? The answers to these questions and more will help visitors connect with you and feel comfortable hiring you.

- Contact Information Sitewide: Last, but certainly not least, it’s imperative your agency offers a way for visitors to contact you on every single page of your website. The easier it is for people to reach out to your team and express interest in your services, the easier it will be to generate more leads and increase sales. Include prominent buttons to call, email, or send you a message along with a strong call to action on each page to further increase your visitors’ likelihood to engage with your agency.

Providing easy access to important information users are looking for on your website will keep them engaged and increase the potential to turn visitors into customers.

It’s also important to make sure the content on your website speaks directly to your visitors. The more they feel like you get them and understand their needs by the content you’ve added to your pages, the more likely they will be to contact your agency.

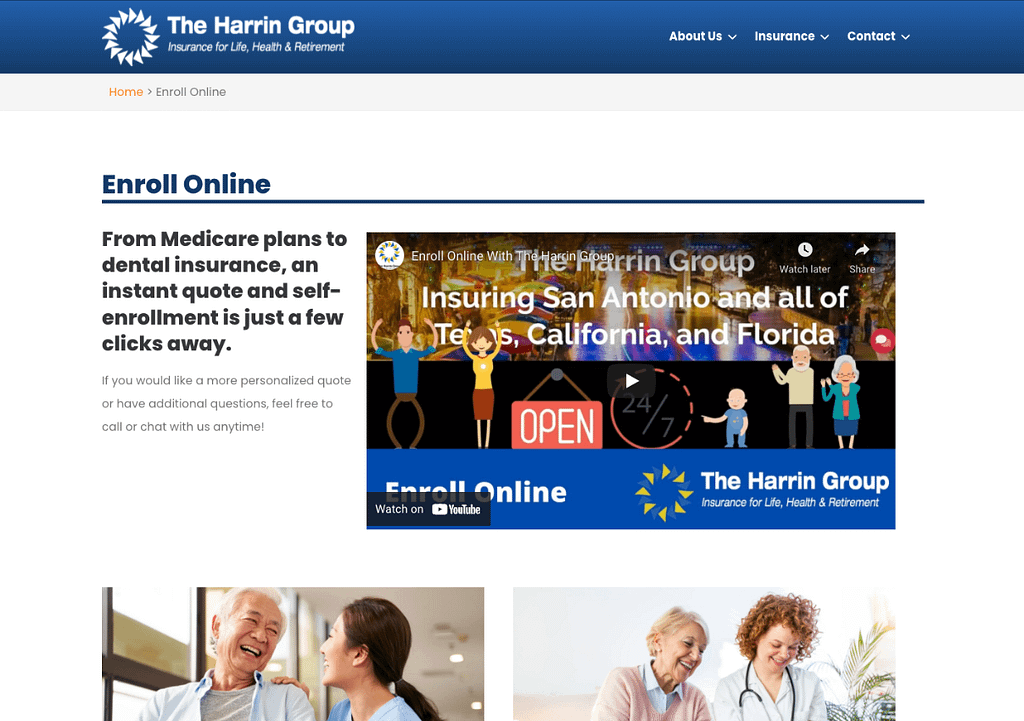

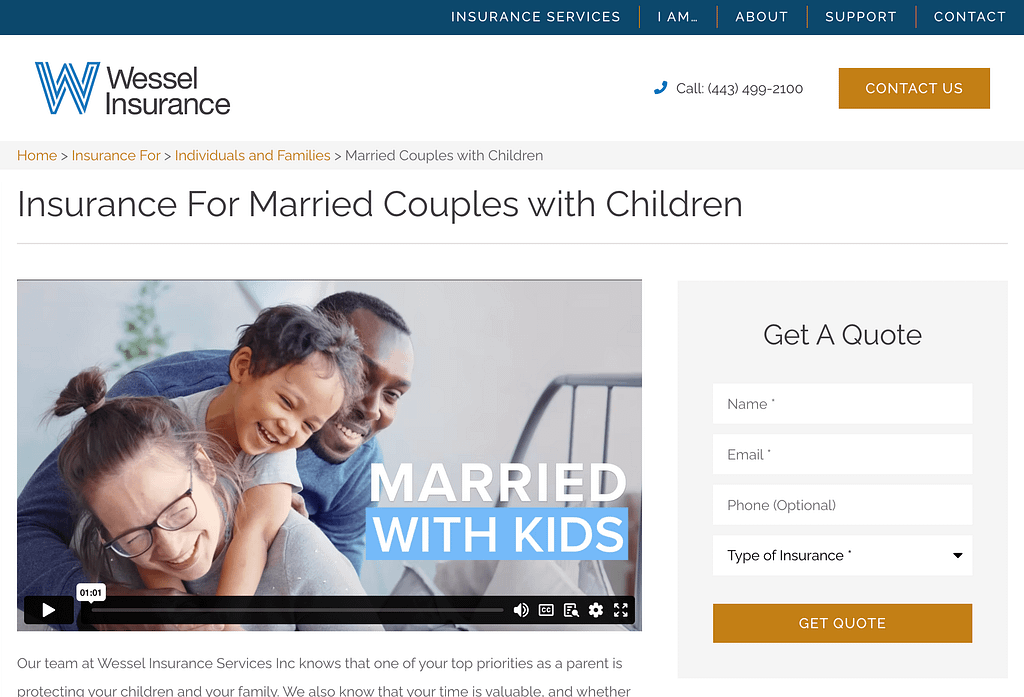

At BrightFire, we’ve created a set of seven personal insurance pages geared to address the insurance needs of various customer personas in different stages of life, including:

- Insurance for College Students

- Insurance for Single Adults

- Insurance for Married Couples without Children

- Insurance for Married Couples with Children

- Insurance for High Net Worth Individuals

- Insurance for Empty Nesters

- Insurance for Retired People

We will also release a series of commercial insurance personas pages and videos later this year. By highlighting these groups of people and businesses, website visitors will be able to more easily identify the content most valuable to them and will be encouraged to contact your agency for more information on the types of coverage that will best suit their unique needs.

Regularly Updated Blog

If you don’t already have a blog on your agency website, this should be one of your top priorities. Blogs can be amazing for improving your SEO, increasing website traffic, generating new leads, promoting brand awareness, and establishing your agency as an expert insurance resource. In fact, research shows 77% of Internet users regularly read blog posts (Impact), and of B2B users specifically, 71% consume blog content during their buyer journey (Demand Gen).

Blog post traffic is compounding, which means it gains organic results over time. This is why continuously adding new posts and updating old posts are important. This gives you more reads, more recognition, and possibly, more followers.

Also, don’t forget about internal linking, whether that be to another page on your agency website or to another blog post. Not only does this encourage visitors to explore related content on your website, but internal links also pass on an SEO ranking factor called “page authority,” thus helping the linked webpage or blog post rank better.

Companies that publish at least 16 blog posts per month generate 4.5 times more leads than those that publish no more than 4 posts.

Source: HubSpot

Search Engine Optimization (SEO)

Search engine optimization is essential for every insurance agency. It’s important to start investing in SEO as soon as possible and stay committed to improving your SEO as time goes on. SEO is a long-term, organic lead generation solution that takes time to gain traction. Basically, SEO is the process of improving the visibility of a website or webpage on search engines like Google. You can build a beautiful website, but it’s not going to matter if it can’t be found by individuals searching the web for insurance quotes.

Lasting SEO takes time and patience. Insurance agencies should consider engaging with experts in insurance SEO they can trust to keep their website optimized. Without effective SEO, chances are the only people that will see your website are those who already know your company and physically type in your website address.

For this ultimate guide, the part of SEO we’re going to focus on is “on-site” SEO, which refers to your website code and content.

On-site SEO, or on-page SEO, is the practice of optimizing elements on a website in order to improve search engine ranking and visibility. This involves optimizing both the website content and source code behind it that runs your website. Whereas “off-site SEO” involves building backlinks, local business listings, and online customer reviews.

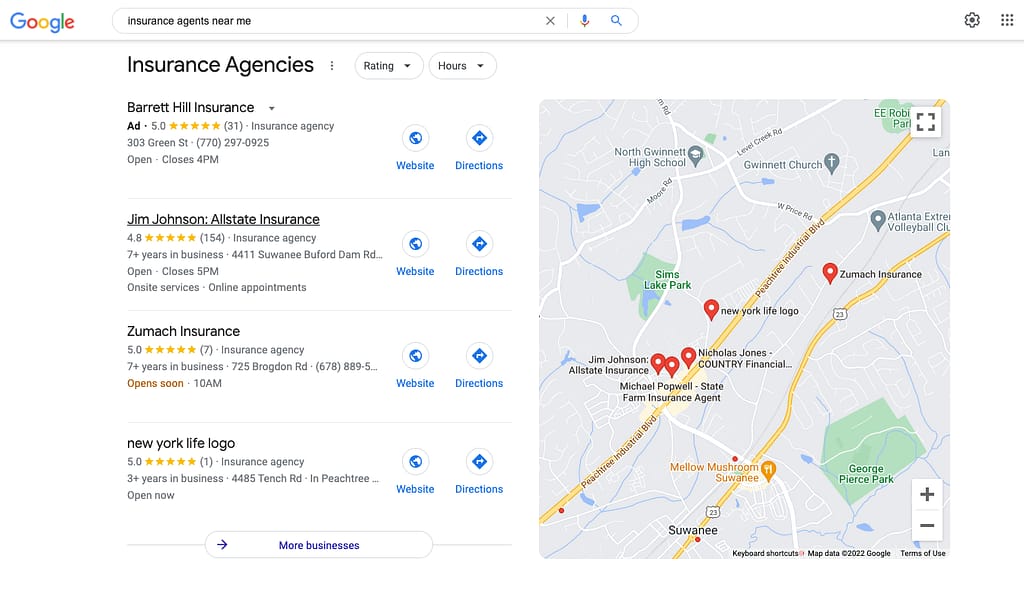

Google Optimized Local Search

You may have heard of local SEO without realizing just how important it is to a local insurance agency. Without taking steps to optimize your website for local search, you risk falling behind your local competition.

You have to clearly demonstrate that you’re a local business and that you’re one of the most trustworthy among your local competitors. Search engines use what is referred to as local signals from:

- Your Agency Website

- Social Media

- Other Local Area Websites

- Online Review Sites

- Business Directories

Whether you’re an insurance agent in a metropolitan area or a small town, local SEO is critically important to receive high rankings in local search results.

High-Quality Page Content

Page content is the heart of on-page SEO. It tells both search engines and website visitors what your website and business are all about and how you can be of value, whether it be a detailed blog post or a concise insurance coverage page.

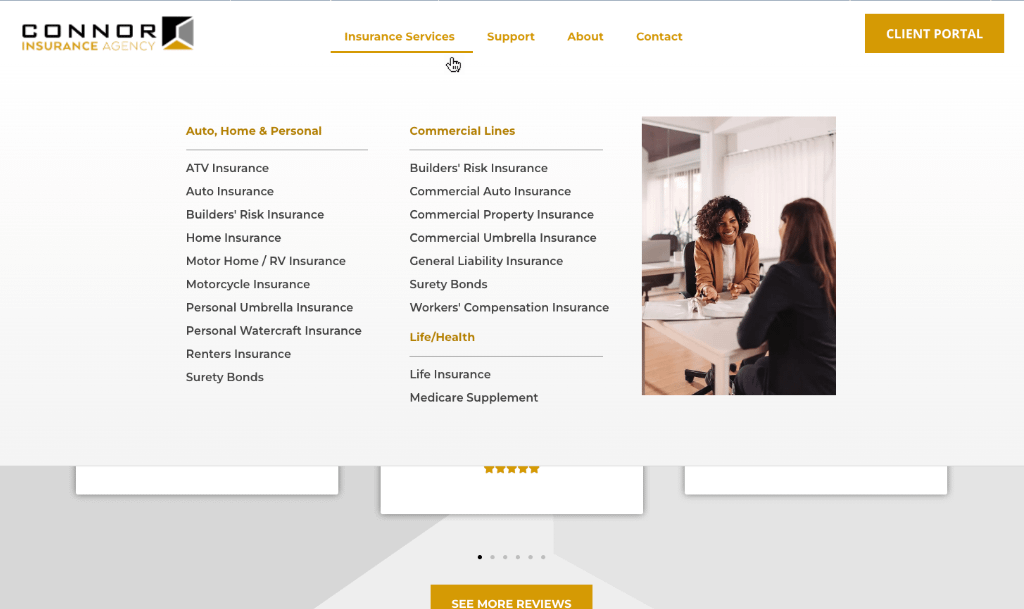

Google favors websites that produce regular, fresh, and relevant content on a particular subject such as insurance. The best places for content in an insurance agency website include:

- Insurance Coverage Pages – You should describe each insurance coverage you offer. Organize your coverage areas by personal insurance, business or commercial insurance, life insurance, health insurance, Medicare, and employee benefits. Then, have a dedicated page for each insurance service, such as auto insurance, business owners package (BOP), or renters insurance.

- Blog Posts – Create fresh content regularly. You or your digital marketing company should regularly publish blogs covering subjects within your insurance services. It’s recommended to publish new content each week.

You should prioritize relevance, consistency, and quality. In addition, you should use variations and synonyms of your target keyword in the content in an organic manner.

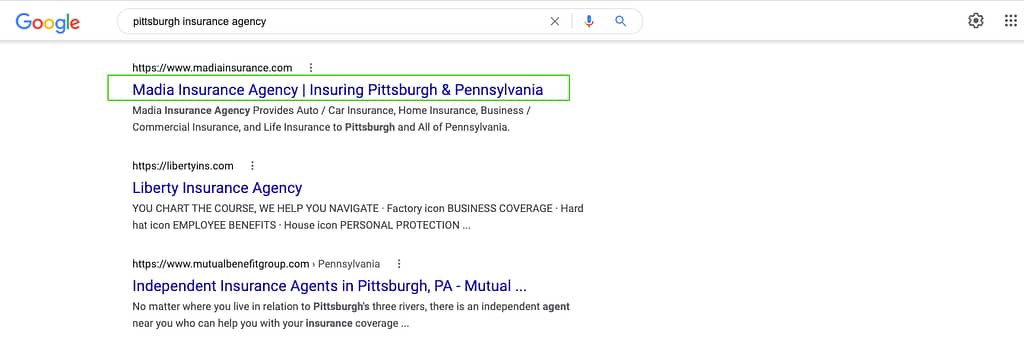

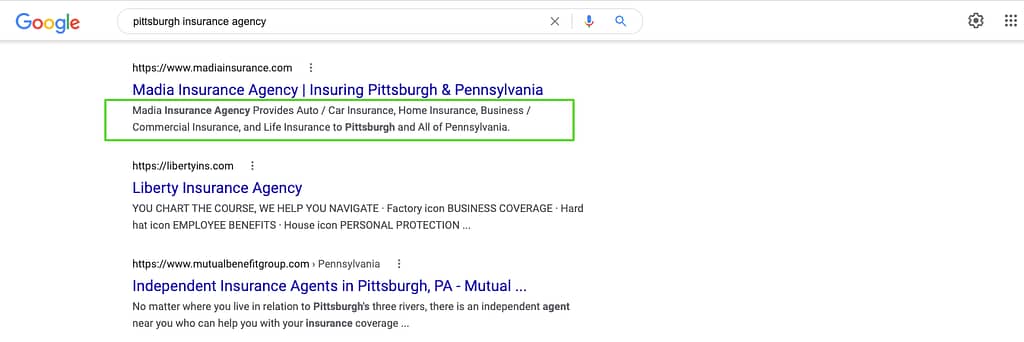

Page Titles

Your website’s page titles (or title tags) are one of the most important SEO elements. The title tag provides an initial short description telling both visitors and search engines what they can expect to find on a given page.

To ensure your agency website pages have the best chance to rank for keywords relevant to the content, it’s important to include the keywords for each page in the title as naturally as possible.

Some best practices for page titles include:

- Keep titles within 50 to 70 characters per Google’s current guidelines. Your titles will be displayed on any Google search results linking to your website, so longer titles may be cut off or completely replaced by Google on search results pages.

- Don’t stuff your titles with keywords. Not only does keyword stuffing present a spammy and tacky reading experience, but Google is smart enough to know what’s happening and may penalize your page.

- Your titles should provide a clear indication of what a visitor can expect to find on your pages. When visitors read a title and click on the link, they expect to find content relevant to that title. If you create a keyword-stuffed title and offer unrelated or low-quality content on the corresponding page, visitors will quickly leave your site, potentially increasing your bounce rates, lowering your search engine rankings, and costing you potential customers.

Meta Descriptions

Meta descriptions are the short page descriptions that appear under the page title in search results. Although it’s not a ranking factor for search engines, it can influence whether or not your page is clicked on in search result pages; therefore, it’s important to optimize these for on-page SEO.

Optimizing meta descriptions can help improve:

- Click-through rates (CTR) from search engine results pages

- Perception of the quality of the result

- Perception of the relevancy of the result

The meta description should be between 120 to 160 characters long and should also contain your main keyword(s) for that specific page. The description should be written in an active voice and compelling in order to help persuade the user to click and visit your site.

Headings

Headings help website visitors and search engines to read and understand sections of text. Essentially, headings act as signposts that guide readers through a webpage or blog post and should indicate what a section or a paragraph is about.

Website readers like to scan content to get an idea of what the page is about and to decide which sections of the page they’re going to actually read. Headings help them identify the sections of content that are most relevant to what they’re looking for. Scanning the page becomes significantly harder for your readers when the page doesn’t contain headings or if those headings are not informative.

The primary header, called an H1, is typically reserved for the title of the page.

There are also sub-headings that range from H2 to H6, although using all of these on a page is not typical or required. The hierarchy of headings ranges from H1 to H6 in descending order of importance and can be nested. Think of your headings as an outline or table of contents for each page’s content.

Each page should have a unique H1 that describes the main topic of the page. As the main descriptive title of the page, the H1 should contain that page’s primary keyword or phrase.

Website Addresses

A website address, also known as the URL, is what you type into your browser to directly visit a website, whether it be the homepage or a specific page of a website.

SEO for your individual website page addresses is important because keywords in the address are a ranking factor, and short, descriptive addresses can help with user understanding and click-through rates. Like your website visitors, search engines read an address to get an idea of the content on the page.

Ideally, your page addresses should have at least one keyword related to the page’s content, but again, it’s important to avoid keyword stuffing.

Page Speed

Page Speed is the amount of time that it takes for a website page to load. A page’s loading speed is determined by several factors, including a website’s server, page file size, and image compression.

Google has indicated that site speed and page speed are signals used by its algorithm to rank webpages. A slow page speed means that search engines can crawl fewer pages using their allocated crawl times, and this could negatively affect your website’s ability to have pages indexed by Google.

Google has used page speed as a ranking factor since 2010. In 2018, Google ramped up the importance of page speed with the “Speed” update, which affects pages that deliver the slowest mobile experience to users.

Page speed is also important to user experience and conversion rates. Pages with a longer load time tend to have higher bounce rates and lower average time on page. Longer load times have also been shown to negatively affect conversion rates.

You can quickly and easily evaluate your page speed on mobile and desktop with Google’s PageSpeed Insights.

Fresh Blog Content

As we briefly mentioned earlier, search engines value updated and relevant content. Your insurance coverage pages will probably rarely change, so incorporating a blog with weekly content that addresses relevant insurance topics will help you build a relationship with your readers and provide new content for search engines to index. You can include an area on your homepage for recent blog posts to ensure your home page is regularly updated with new content snippets.

Blogs show authenticity and build credibility with current and prospective clients, as well as search engines. Insurance agencies that actively blog have more ways to be found, inform their visitors, and share their thoughts and perspectives to be seen as a thought leader in the industry.

Businesses that consistently write blogs as a part of their content marketing receive 67% more leads monthly than those that don’t.

Source: Demand Metric

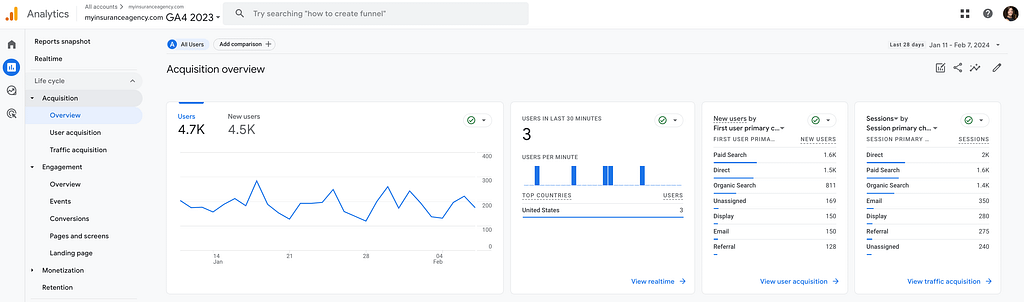

Website Analytics

Google Analytics 4, or GA4, is the most widely used website analytics tool today, and it’s completely free. The tool allows you to track and analyze critical data on your website and website visitors. The volume and types of data GA4 provides makes it an essential component of any digital marketer’s toolkit.

GA4 provides a 360-degree picture of how your website is performing. It collects large amounts of data and then generates reports to display that data to you. Those reports are what you can use to gain pivotal insights into your website, such as the people who visit it, how they found you, and their behaviors once on your website. You can see your paid and organic search engine traffic, most popular pages, visitor locations, which devices visitors are using, traffic sources, and so much more.

Visitor Conversion/Lead Generation

When it comes to making a sale, first impressions count. Your website will be one of the first things a potential buyer sees, and with only 50 milliseconds to catch their attention (Taylor & Francis Group), it’s vitally important that your agency website is modern and professionally designed.

Your website should be working hard generating leads for you, as long as you are supplying it with the tools and content it needs to perform effectively.

Reviews & Social Proof

Recently, conversion rate optimization has become a major focus for digital marketers. After all, what good is putting all that time and effort into SEO and Pay-Per-Click Advertising to drive traffic to your insurance website if the visitors don’t turn into leads and ultimately new policies?

Adding social proof such as customer reviews to your website is a great way to increase your conversion rate. In fact, product reviews are 12 times more trusted than product descriptions and sales copy written by vendors (Trustpilot). In other words, consumers want proof from their peers and unbiased 3rd parties, not the vendors selling the products or services.

Just make sure those reviews are authentic and from actual policyholders. Also, don’t be afraid to include reviews that are average or less than five stars. Studies have found that people tend to trust a set of reviews containing some negative responses more than a set of perfect, five-star reviews.

72% of buyers appreciate negative reviews on products and services, saying that these “help provide depth and insight to make a decision.” 67% of consumers want a mix of both positive and negative reviews.

Source: G2

When it comes to reviews and website conversions, both the quantity and quality matter. For example, when you’re looking to buy a television on Amazon, you want to know how many people bought the TV and how many thought it was an excellent product, as well as why those who rated it poorly did so.

There’s a certain amount of credibility that comes with a large quantity of reviews. It takes away some of the doubt and hesitation you’d normally experience, especially for a purchase in which it’s difficult to assess the quality or value, like an insurance policy.

So quality and quantity of reviews matter, of course, but so does how you display the reviews.

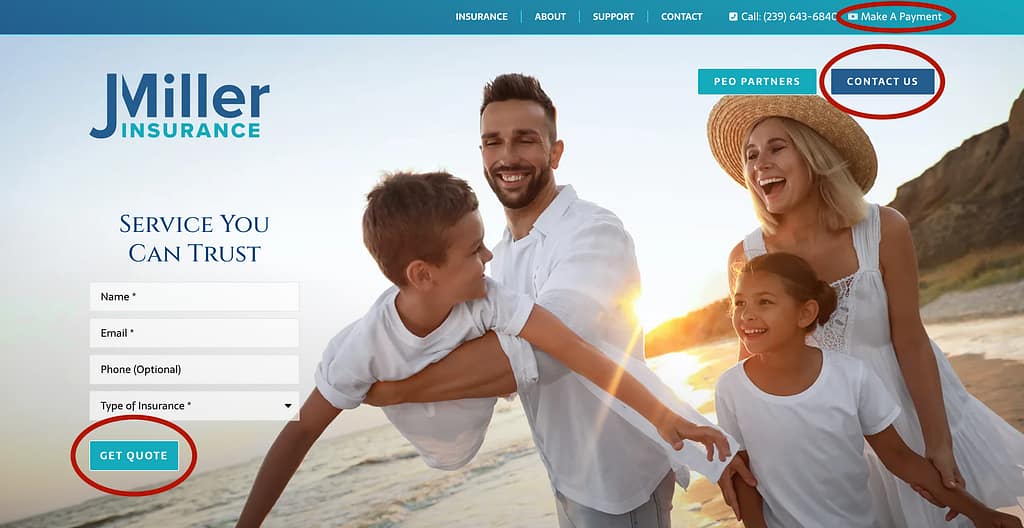

Placing reviews at critical locations in your prospects’ browsing journey through your website can help convince them to take your desired action (complete a quote request form, use an online rater, call you, etc.). Here are five locations on your website where you should include reviews:

- Homepage

- Next to Quote Request Forms

- Dedicated Reviews & Testimonials Page

- Each Insurance Service Page

- Pay-Per-Click Advertising Landing Pages

86% of consumers believe that reviews older than 3 months are no longer relevant. 73% say customer reviews must be from the last month.

Source: BrightLocal

In addition to ensuring your online reviews are highly visible on your website, it’s essential you promote the review sites your agency is represented on and ask new customers to leave a review.

For more information and helpful tips on managing your reviews online, see BrightFire’s Ultimate Guide to Online Reviews for Insurance Agencies.

Some people buy insurance locally because they realize that spending money where they live boosts the local economy. Others may think that because they can meet you face-to-face, they’re more likely to be a valued customer and receive excellent service.

Don’t be afraid to appear to be the local insurance agency you are. Be confident promoting your offerings and showing that you’re connected to the local community to help earn the trust of your local consumers.

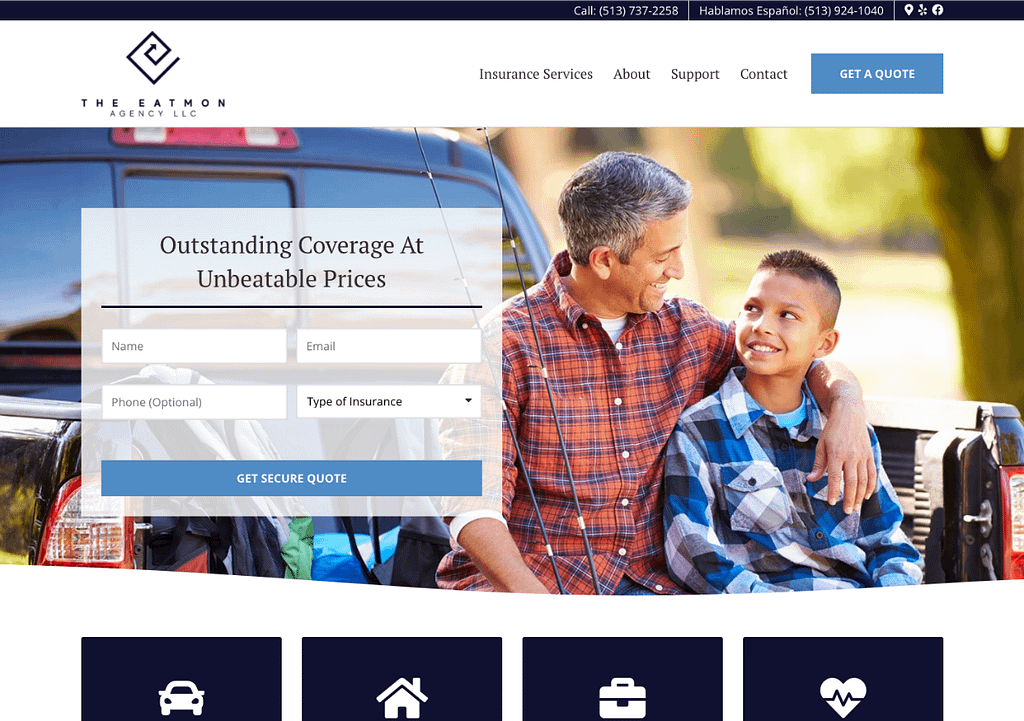

Quote Forms/Lead Generation Forms

Nobody enjoys filling out forms, but at least you can minimize the pain for your users by ensuring that your insurance quote forms are as easy to use and as well-designed as possible.

Keep forms short and simple. The fewer the number of fields, the better. Ask only for the information you need in order to get the lead and start a relationship. You can get the details regarding date of birth, address, VIN number, or the year the house was built later. Equally, asking users how they “heard about you” at this stage in the relationship just adds to the frustration and rarely gets answered honestly by users looking for a quote.

Do not require the user to provide their phone number. Including a field for phone number on your contact or quote form significantly decreases conversion rates.

Source: HubSpot

In today’s online marketplace, people do not like to give out their phone numbers. This is mainly because they don’t want overzealous sales people calling them repeatedly or they fear that their information will end up on a solicitation list. People usually won’t give their phone number to someone they don’t know and trust.

Requiring a phone number lowers your conversion rate, so try to wait and ask for it later in the sales process when the relationship isn’t brand new, or at least make it an optional field.

Lastly, display customer reviews near your quote forms to reduce perceived risk and build social proof. According to BigCommerce, 72% of consumers trust a business more as a result of positive reviews and testimonials. The strategy of combining social proof with your insurance quote form is extremely important to build trust, increase credibility, and validate the customer’s buying decision.

Website Content

Every visitor came to your agency website for a reason – to look for a quote, submit a claim, or maybe find their agent’s contact information. Understanding these motivations is vital when it comes to creating quality content that helps your website drive new business and provide excellent customer service. Each visitor has their own needs and wants. Your website’s ability to deliver on those needs and wants for each person starts with your ability to understand them and speak to their specific situation.

Clarity always beats technical language, so avoid using complex insurance jargon as much as possible. Do not try to impress people with fancy, complicated insurance terminology – it just doesn’t work. You should write website content for ordinary people, since they’re the people who are reading your website. Don’t write for industry colleagues; write for people shopping for insurance.

Provide plenty of whitespace around website content and remove clutter or distractions. It’s tempting to try to cram a lot of related information on a page. As insurance agents, you know your services inside and out and know all the variations in coverage. It’s understandable to want to provide as much information about your services as you can in order to be as accurate as possible, but sometimes less is more.

Website readers need space to pause, analyze, and consume different bits of information on the page. Whitespace helps them do that. It provides a natural structure to the page so that the visitor can easily scan for the information they are seeking. Improving the quality and usability of your content in this way is a great way to improve conversion rates on your website.

Calls to Action (CTAs)

Every great webpage has a call to action. If the page doesn’t direct the user to a next step, the conversion rate will be very low. If the page includes a clear call to action, expect an increase in responses and improved conversion rate.

Use first-person language. First-person language is powerful because it becomes the internal dialog in the visitor’s mind. Rather than talking at them, the call to action speaks to them.

Lastly, be cautious not to add too many CTAs on a webpage. What frustrates users most is seeing multiple CTAs and not being able to understand which one they should act on.

If you have “Sign up for my insurance newsletter,” “Like me on Facebook,” “Learn more,” and “Get a quote” buttons in the same area of the page, a visitor is bound to be confused about which action to take next. Instead, choose your CTAs wisely and ensure they make sense in the context of their placement and the content around them.

Prominent Phone Number

When customers want to pick up the phone and talk to a human being at your agency, having to dig for your contact information is frustrating and can make your agency seem less trustworthy.

Prominently displaying your phone number on every page of your website will increase your conversions and your leads. Your customers will be more at ease, knowing that they can reach out to a real human to get their questions quickly answered. Plus, a real person can be much more persuasive and is more likely to close a deal than your website, since a human can speak to the particulars of their situation. Not to mention, there are still a lot of people who prefer to call and talk to a real person when engaging in a business transaction such as insurance.

Don’t make your potential customers think twice about working with you. Make sure your phone number is prominent and easy to find on your agency website to increase website conversions.

Insurance Sales & Support Tools

As previously mentioned, it’s imperative to make your website work for your agency. View your website as an extension of your sales and support teams. Consider the sales workflows your team implements to convert a new lead. What sales strategies do they have in place? What verbiage do they use? Are there tools and platforms your agents utilize to build relationships with leads, increase your agency’s credibility from a lead’s perspective, or manage how often and when to follow up next with their leads?

In this section, we’ll do a deep dive into a number of online sales tools and support tools your agency can use to maximize your time, strengthen relationships, and write more policies. BrightFire provides our Insurance Agency Website customers with our Sales Tool Suite and Support Tool Suite, which includes Notification Bars, Video Proposals, My Agent Personalization, Insurance Carrier Database, live chat, calendar scheduling, Promo Panels, Conversion Cues, and other third-party technology integrations.

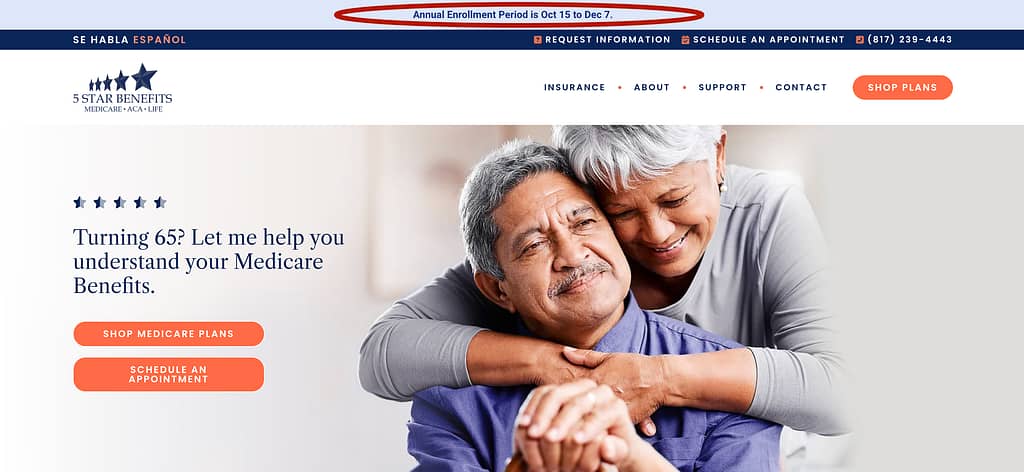

Notification Bar

An easy, eye-catching way to quickly notify customers of any altered business hours, holiday office closures, COVID-19 precautions, and other promotions or current events within your agency is through the use of a Notification Bar. Displayed across the top of your website, the Notification Bar can help you share pertinent or timely information with your website visitors.

By activating this sales tool, you can help customers better understand your agents’ availability on any given day or holiday, as well as how they can best reach your agency. Notification Bar messages can be scheduled ahead of time and given an expiration date to be taken down automatically, or kept active until you decide to take them down.

Video Proposals

Following up with sales leads and attempting to walk through proposals you’ve emailed them can be tedious and difficult, especially when busy schedules don’t allow for a call. To personalize and simplify this process, your agents can record a video of them explaining and walking through their proposals and email a link to view the video to prospects.

This strategy is more engaging for consumers and offers agents a way to better explain the various elements of a proposal that can often entail technical insurance jargon the average individual may not understand when reading it on their own.

Fortunately, BrightFire has a Video Proposal feature to make this personalization strategy even easier for insurance agents, while also allowing them to leverage their website. Simply record your screen and/or webcam, complete with audio, walking an individual prospect through their proposal. Then, share the video with them using a password-protected link through your website.

Here’s a short demonstration video of BrightFire’s Video Proposals feature.

My Agent Personalization

It’s no secret that millennials are changing the way companies interact with their customers, especially online. Consumers nowadays want highly personalized experiences that speak directly to their needs and wants.

71% of consumers expect companies to deliver personalized interactions.

Source: McKinsey

One excellent tool to help personalize your website’s user experience is BrightFire’s My Agent Personalization. This Sales Tool Suite feature enables agents and producers to add a personal identifier to any link to your website to display their personal contact information on every page of your website as the recipient of that link browses your site. Using their custom link, an agent can easily display their photo and contact information on every page, offering a personal touch that encourages their contact to connect with them.

This website feature simplifies and enhances the user experience so that visitors using a My Agent Personalization link will never have to hunt for their agent’s contact info.

Here’s a short demonstration video of BrightFire’s My Agent Personalization feature.

Insurance Company Database

As an independent insurance agency, it’s important to show website visitors your full line of insurance carriers. At BrightFire, we feature your most important carrier logos on the homepage. We also include a page about your insurance carriers that shows off all of their logos. Each carrier even has its own landing page that talks about your relationship with that carrier.

Additionally, our built-in Support Tools Suite includes pages to file a claim and make a payment that lists contact information and important links to the carrier website to provide ease of use and access for your policyholders.

Live Chat

Visitors often have questions about a brand’s products or services and want immediate answers while browsing a website. That’s why it’s common practice for brands to have an instant messaging or chat feature on their website.

Typically found at the bottom right corner of each page on a website, live chat can help insurance agencies boost lead generation and conversions by offering agents a way to answer a visitor’s questions and personalize their experience while they are still on your website. Additionally, your customer support team can offer relevant articles or responses based on frequently asked questions.

While you may be hesitant to offer live chat on your website, having this feature available could help you better engage with your prospects and quickly convert them to customers. In fact, according to Tidio, 41% of customers say they prefer real-time customer service via live chat over other methods, such as email or phone support.

Use this convenient online sales tool to ask new visitors questions to engage with them, build trust through conversation, and move them down the sales funnel more easily by connecting with them in real time.

Connecting a live chat feature on your website is easy, especially if your agency already uses an online chat platform such as Chatra, Facebook Messenger, or Zendesk Chat. Simply install the chat platform’s plugin, connect it to your agency’s account, and activate the chat.

Live chat can remain active on your website even if there isn’t an agent available online to respond right away. Visitors can leave a message that will send your team an email if no one at your agency is available.

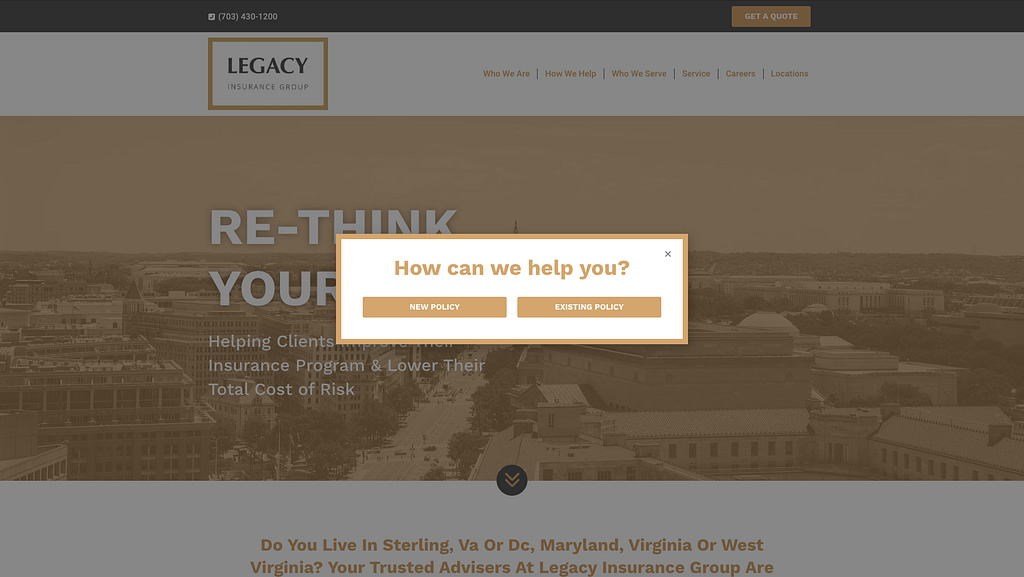

Calendar Scheduling

Another great online sales tool you should consider integrating with your website is calendar scheduling. This feature gives your website visitors an easy way to schedule an appointment with one of your agents or producers at their convenience, saving your agency time while allowing you to book more appointments and close more sales.

Calendar scheduling benefits your customers in a number of ways. Not only is it easy for them to select an open time slot and schedule a call at their convenience, but your agency can also show only the days, hours, appointment types, and personnel of your choosing. You can even select how soon in advance appointments can be scheduled. This tool also makes it easy for you to connect to your agency’s current scheduling service, including Acuity Scheduling, Calendly, Doodle, and many more.

This is a huge benefit to your agency, as your staff doesn’t need to be available to help customers create appointments. Customers can schedule a call 24/7, instead of having to wait for business hours to make an appointment. This offers a more seamless customer experience, as the traditional back and forth of booking a call is eliminated.

Calendar scheduling saves your agency time and money with improved operational and staff efficiency by spending less time booking sales calls and sending automatic appointment reminders to minimize no shows. Customers can easily add the appointment to their own online calendars, and they can even reschedule appointments for another time on your calendar without having to correspond.

Promo Panels

When you want to help prompt website visitors to take a specific action on your website, BrightFire’s Promo Panels are a great option to integrate with your website.

These subtle yet powerful on-screen website notifications can improve your website’s conversion rate while helping you establish trust and credibility with your visitors by:

- Promoting a Time-Sensitive Deadline, Such as Open Enrollment

- Sharing Your Latest Customer Review

- Featuring An Industry Award

- Promoting Your Agency’s Contests or Giveaways

- Encouraging Visitors to Get a Quote

- Showcasing the Benefits of Working with an Independent Agent

- And More

Your agency can choose to leverage multiple Promo Panels on your agency website simultaneously if you have several important messages you want to share with your visitors. If you activate multiple Promo Panels at the same time, they will rotate like a slideshow as visitors browse your agency website, as shown in the example below. Our sorting functionality even allows you to control the order in which you want your active Promo Panels to appear.

Real-Time Quoting Integration

Agents can also leverage their websites to provide insurance quotes to website visitors 24/7 through real-time quoting integration features. Similar to calendar scheduling, this feature allows agents to improve operational efficiencies and save time generating quotes for visitors.

BrightFire offers two types of real-time quoting integrations – carrier-specific instant quote integration and comparative rater integration. A carrier-specific instant quote integration can be provided by carriers such as Progressive, Nationwide Express, Erie Insurance, Dairyland, Safeco, American Collectors, Hagerty, Mercury, and USLI. Some of the most popular comparative rater integrations include Vertafore PL Rating, Applied Rater, Compulife, EZLynx, AgentSecure, Boston Software, and bolt access.

Smart Quote Forms

With 76% of consumers willing to share their data in order to create a more personalized experience (Merkle), there’s no doubt your agency needs to be strategic in how agents respond to prospects after expressing interest via a form submission.

To best personalize and simplify a website visitor’s request to receive a quote from your agency, you should utilize smart quote forms. Designed to convert visitors into leads, smart quote forms are highly customizable and offer a reduced number of form fields in order to boost conversion rates. To continue a prospect’s online customer journey through your website, you can also customize an on-screen confirmation message after a quote form is submitted, or you can redirect leads to another page of your website.

This online sales tool can integrate with many instant quote services that otherwise wouldn’t capture contact information until an in-depth questionnaire is completed, as well as several popular email marketing platforms to automatically add leads to your email marketing list. In addition, the smart quote forms offered by BrightFire have the ability to send custom text and/or email notifications to the right agent or group of agents based on the type of quote request. For example, all personal insurance quote requests can go to your personal lines agents, and all commercial insurance quote requests can go to your commercial lines agents.

Conversion Cues

Another helpful tool in BrightFire’s Sales Tool Suite is our Conversion Cues. Aimed at grabbing your website visitors’ attention and converting more prospects into policyholders, Conversion Cues are important notifications that can appear on your website following a trigger of your choosing.

Shown in the examples below, you can leverage Conversion Cues for a number of reasons, including to guide your visitors to the information they’re looking for or to promote your mobile app. You may also decide to use Conversion Cues to encourage your visitors to get a quote, subscribe to your email list, read your blog, check out your awesome customer reviews, follow your agency on social media, and more.

Both of the examples below appear as soon as the website loads; however, you can customize your Conversion Cues to trigger at key moments during a consumer’s journey, such as on page load, when a button is clicked, after scrolling past a certain point, after a period of inactivity, when there’s intent to exit the page, etc. They can be configured to display on every page of your website or only on specific pages.

Part 3 – How Does Your Agency Website Fit Into Your SEO Strategy?

We’ve already touched on the importance of integrating search engine optimization (SEO) strategies into your website content to help your agency rank higher in Google, Bing, and Yahoo. But SEO entails much more than just your website content.

In fact, there are three main components to a successful long-term SEO strategy: website optimization, accurate, well-managed local listings, and a consistent stream of positive customer reviews. BrightFire offers the Ultimate SEO Bundle that covers each of these three bases to help your agency stand apart from your competition and attract new insurance buyers.

Insurance Agency Websites

Offering everything your agency needs to attract and convert insurance buyers online, BrightFire’s Insurance Agency Websites are optimized for the insurance policies your agency sells. As a certified Google Partner, BrightFire stays abreast of Google’s updated services, policies, and ranking factors to make updates behind the scenes of each of our client’s websites so they don’t fall behind in search rankings.

Our digital marketing experts take thorough care of your website, managing and installing updates, monitoring security, and ensuring that everything runs smoothly.

Reviews & Reputation Management

While having effective SEO in place on your agency’s website is a great first step with search engines, online review sites like Google, Yelp, and Facebook also strengthen your SEO strategy and online rankings while also improving your brand’s reputation in the eyes of your prospects and customers.

In fact, a BrightLocal study found that 98 percent of people read online reviews for local businesses, and 88% of them trust online reviews as much as personal recommendations (Neilsen).

These statistics highlight the need to properly set up, monitor, and manage your online reputation and customer review sites. But with many review profiles to keep track of, BrightFire is here to help your independent insurance agency grow, nurture and protect its online reputation with ease.

Our Reviews & Reputation Management service is a great solution for generating reviews from your clients while improving your online rankings, gauging your customer’s happiness, and staying connected with your customers.

Local Listings Management

From Google and Yelp, to the Better Business Bureau (BBB), Yellow Pages, Tom Tom, and more, the number of local business listings (also called citations) generating information about your agency for consumers to find online is endless.

And while it’s great for your agency to be represented on so many platforms, it becomes increasingly important and difficult to manage each listing and ensure your agency’s information (i.e., website, name, address, phone number, etc.) is correct on each one.

With BrightFire’s Local Listings Management service, our digital marketing experts help your agency get found across the web so consumers can easily reach your agency, with or without visiting your website. Our team accomplishes this by ensuring your business information is accurate and consistent on more than 50 local listings across the web, including Google, Bing, Apple Maps, Google Maps, and major data aggregators. We also keep an eye out for duplicate listings and remove any we find, as these can negatively impact your SEO rankings.