Positive online reviews play a pivotal role in boosting an insurance agency’s online reputation and your website’s SEO. But managing each review platform, generating new reviews, and responding to each of them can be overwhelming. And what happens to your reputation if your agency receives a negative review?

View this webinar on-demand as Director of Operations Bob Whitis debunks 5 common misconceptions about online reviews so your agency can learn to love them and leverage them to protect your online reputation, improve your SEO rankings, and generate new reviews with ease.

5 Insurance Online Review Myths

Watch the webinar, read through the full transcript, or jump ahead to the section you’re most interested in to get the truth about online reviews for your insurance agency.

- Online Reviews Don’t Matter

- Agents Don’t Have Control Over Their Online Reputation

- Getting A Negative Review Ruins An Agency’s Reputation

- Positive Reviews Don’t Require Attention

- Agencies with a 5-Star Rating Don’t Need Any More Reviews

- How BrightFire Helps with Online Reviews

Watch the Webinar

Additional Questions?

If you have any questions about what we discussed in the webinar or BrightFire’s Reviews & Reputation Management service, or our Ultimate SEO Bundle, please schedule a call with sales.

Webinar Transcript

Hello everyone! My name is Bob Whitis, and I’m the Director of Operations here at BrightFire, as well as your host for today’s webinar. Thank you all for joining us.

In July, we covered Planning a Month of Social Media Content for Agents. If you missed it, or any of our previous webinars in the 20 Minute Marketing Webinar series, you can access the whole series on-demand by visiting brightfire.com/webinars.

Our goal with these webinars is to provide you with digital marketing advice and discuss current digital marketing topics in a brief 20-minute format followed by a Q&A period to answer any questions you may have. If you have questions during the webinar, please use the Q&A feature. We’ll do our best to answer all of the questions that come through; otherwise, we will personally reach out to you afterward.

Today’s webinar topic is Debunking 5 Myths about Online Reviews for Insurance Agents. Positive online reviews play a pivotal role in boosting an insurance agency’s online reputation and your website’s SEO. However, managing each review platform, generating new reviews, and responding to each of them can be overwhelming. And what happens to your reputation if your agency receives a negative review?

In this webinar, we’ll identify and debunk 5 common misconceptions about online reviews so your agency can learn to love them and leverage them to protect your online reputation, improve your SEO rankings, and generate new reviews with ease.

Today’s webinar is being recorded, so everything we discuss will be saved and emailed to you in the next business day or two so you can watch it later on-demand.

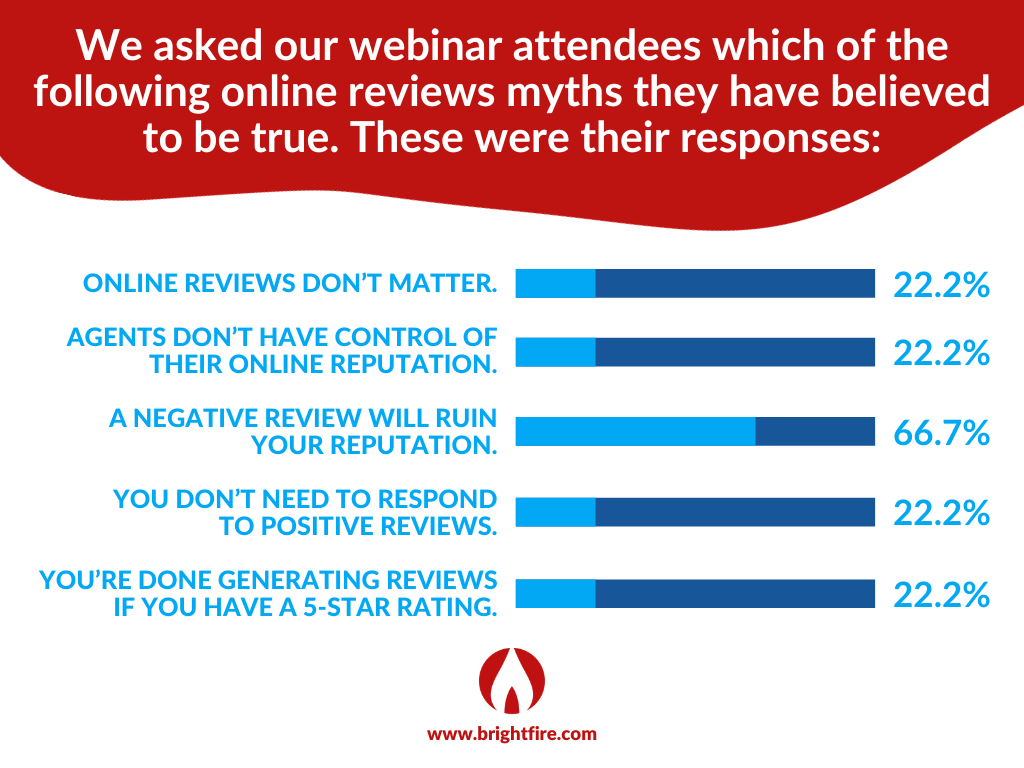

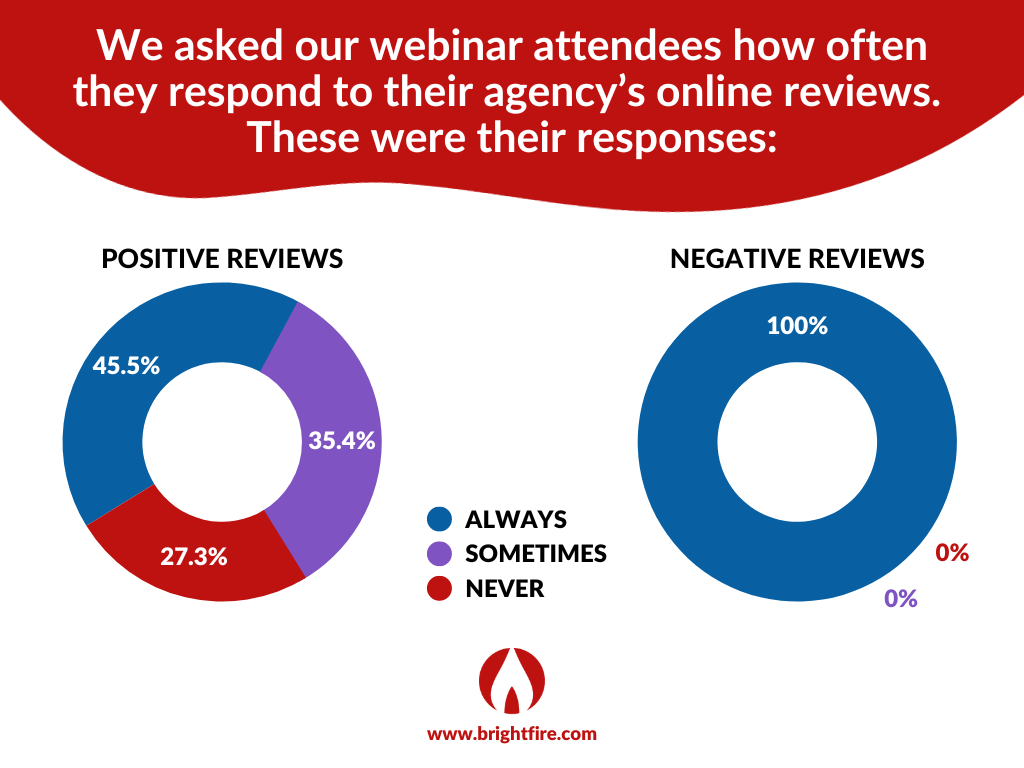

Lastly, we do have a couple of polls for today’s webinar. When launched, you’ll see the poll pop up on your screen with the question and response options. Every poll is anonymous, and we’ll give you roughly 30 seconds to share your response, and then we’ll discuss the results with the group.

About BrightFire

Before we dive into our 5 common online review myths, I’d like to share a brief background on BrightFire, since we have a mix of current customers and agents that are new to BrightFire attending today.

BrightFire began by providing insurance agency websites in 2000. Over the years, as the needs of insurance agents grew, we expanded our digital marketing services beyond agency websites to also include:

- Search Engine Optimization

- Social Media Marketing

- Local Listings Management

- Pay-Per-Click Advertising

- Social Media Marketing

- Reviews & Reputation Management

Currently, there are over 2,500 independent agencies across the nation using at least one of BrightFire’s digital marketing services.

So with that background on BrightFire, let’s get started.

What’s Ahead

Being in the insurance marketing industry for over 20 years and having served thousands of independent agents along the way, we’ve heard and seen it all.

Five of the more common misconceptions about online reviews that we’ve heard over the years are the following: online reviews don’t really matter because no one looks at them before making a purchasing decision, agents don’t have control over their online reputation, getting a negative review will ruin an agency’s reputation, agents don’t need to respond to positive reviews, and finally, agencies with a 5-star rating don’t need to work on generating any more reviews.

So today, we’ll walk through each of these myths and identify the truth behind them for your agency’s benefit. Then, we’ll discuss how you can leverage BrightFire’s digital marketing experts to save your agency time while improving and protecting your online reputation, as well as building stronger relationships with your current policyholders and prospects.

Insurance SEO Myth #1: Online reviews don’t matter.

So let’s dive into the first myth of the day, which is, “Online reviews don’t really matter because no one looks at them.”

It’s very common for people to think that online reviews are nice to have if you have 5-star reviews and look good online, but that they don’t actually matter or even help influence purchasing decisions for consumers.

However, this couldn’t be further from the truth, since 93% of users have made buying decisions based on online reviews (according to Podium).

Online reviews provide consumers with vital information about the customer experience they can expect from an agency and instill confidence in prospects when they read positive feedback. And because 91% of 18 to 34-year-olds trust reviews online just as much as personal recommendations (according to BrightLocal), it’s crucial your agency is present and active on review platforms so you can help build trust and credibility online, attract new customers, and help your agency stand out from the competition.

But the importance of online reviews doesn’t stop there. In addition to influencing the purchasing decision and strengthening your reputation, online reviews can bolster your SEO rankings.

Search engines like Google include factors like online review sentiment, quantity, and recency into their algorithm when ranking local businesses in the search results. In fact, online review signals contribute almost 10% of Google’s 200+ local search ranking factors (according to Podium).

So when your agency has an overall positive rating regarding customer reviews, that tells search engines your agency is a trusted and credible source and helps search engines more confidently display your website and listings to consumers conducting relevant searches about insurance agencies near them.

Insurance SEO Myth #2: I have no control over my online reputation.

Now that we’ve gone over why online reviews really do matter for your agency, let’s dive into our next myth of the day, which is the common belief that agents don’t have any kind of control over their online reputation.

You may relate with agents who are nervous to open their agency up to receiving online reviews for fear that you may receive a negative one. After all, if you don’t create a Google Business Profile or a Yelp business account, people can’t leave feedback and potentially hurt your online reputation, right?

Unfortunately, that’s not the case, because whether or not your agency creates and manages your review profiles, people can still leave a review of your agency. And trust me, they will. A study found that 74% of consumers say they’ve left an online review for a local business in the past year (according to BrightLocal).

So not creating or claiming your agency’s online review profiles is actually a really fast way your agency could lose control of your reputation. If a policyholder writes a review of your agency, but there’s not currently a profile, the platform will create one automatically, which could also result in displaying inaccurate contact information, such as your agency’s website link, business name, address, or phone number.

And if you don’t claim your profiles, you won’t be able to address customer reviews, whether positive or negative, to either thank them for their positive feedback or try to resolve any negative experiences customers have had with your agency.

On the contrary, when you claim your profiles, monitor your reviews, and respond to customer feedback, you’re taking ownership of your online reputation and strengthening it by helping others see your agency is active online and that you care about your policyholders’ experience.

While you may not be able to control what others say about your agency online, you can strive to provide excellent customer service and a seamless online experience with your agency, which can positively impact their impression of your business when they start writing an online review.

And even if you do receive a negative review, you can turn it into a positive opportunity to learn about an area for improvement in your agency. You can then also redeem that customer’s poor experience and reassure prospects that they will have a better experience with your agency by responding to the negative review and sharing what you’ve done to improve or resolve the issue.

Insurance SEO Myth #3: A negative review will ruin my online reputation.

That brings us to our next myth of the day, which is, “A negative review will ruin my online reputation.”

As I mentioned a moment ago, the fear of receiving negative reviews can often make agents hesitant to claim and manage their review profiles.

But I’m happy to inform you that negative reviews aren’t always bad for your agency. That’s because 69% of consumers always or regularly seek out negative reviews to gain a more holistic picture of what experiences they can expect from a business (PowerReviews).

Having a mix of positive and negative feedback can make your overall rating seem much more transparent, genuine, and trustworthy.

And don’t get me wrong, having a 5-star rating is amazing and should be what you strive for, especially if the reviews include descriptions of what your agency did to deserve the great rating. But my point here is that a rare negative review won’t ruin your reputation.

However, it’s important to turn your online reviews into positive outcomes, while viewing them as an opportunity to improve your agency’s customer experience. And that means you should respond to every negative review.

Now, I know some people may think that responding to negative reviews can be more detrimental than ignoring them because it draws more attention to them, but responding promptly and professionally with a resolution-oriented approach can demonstrate your commitment to their satisfaction. It can also show potential customers that your agency cares about feedback and is proactive in resolving their issues.

When responding, acknowledge the customer’s concerns, show sympathy, and add a little marketing to explain what your customers typically experience at your agency. You should also provide your contact information and try to move the conversation offline.

When a situation is appropriately explained online or the issue has been resolved to the customer’s satisfaction, the reviewer is able to remove or edit the original review. And studies show that 30% of consumers admit to reversing negative reviews once their concern has been addressed (Small Business Trends).

Whether or not they reverse the negative review, responding to the feedback shows that you have taken steps to ensure this problem won’t happen to the next customer, which will also reassure future consumers who read that review and your response that they can expect a better experience if they choose to contact your agency.

Insurance SEO Myth #4: I don’t need to respond to positive reviews.

In addition to responding to negative reviews, it’s just as important to respond to positive reviews. This leads us to our next myth, since it is a common belief that there isn’t a need to respond to positive reviews because they speak for themselves.

When you don’t have to defend your agency or reassure future consumers reading reviews that they’ll receive a better experience than detailed in a negative review, it’s easy to feel like you don’t need to add any additional comments to a positive review.

But ignoring any review, whether positive or negative, can create a sense of indifference and unappreciation for customer feedback. It also makes people question whether your agency is active online and available to respond to customers through other mediums like website contact forms or emails.

Your policyholders put in time and effort to go to your online review platforms and share their positive experiences with your agency so others may feel encouraged to contact you as well. That’s a huge deal, especially as a local independent agent.

So make it a habit to consistently monitor for new reviews and respond to every review. Express your appreciation for positive feedback so you can best engage with your satisfied customers and encourage them to continue being loyal brand advocates who may also be bragging about your agency offline through word of mouth.

Insurance SEO Myth #5: I’m done generating reviews if I have 5 stars.

Now let’s move on to the last myth for today, which is, “I’m done generating new reviews if my agency already has a 5-star rating.”

Oh, how we all wish this one were true. The reality is, your agency will never be done generating new reviews, and that’s because 85% of consumers think that reviews older than three months are no longer relevant (BrightLocal).

This tells us businesses must consistently generate new reviews to help prospects feel confident that the customer experience they are reading about in reviews is still relevant to what they can expect to experience if they choose your agency today.

Take a look at these examples here. While these reviews from one and four years ago are great, people who are just now discovering your agency’s listing online might question if they can still expect the agents to continuously research the best deals for their customers as mentioned in the top review, or experience the pleasant atmosphere when they visit in-person as mentioned in the bottom review.

By generating a steady stream of new reviews, you can help set more accurate expectations for prospective customers as to what kind of experience they’ll have with your agency. It will also help increase the overall amount of reviews your agency has online, better offsetting any negative reviews by bumping up your overall star rating.

And, to bring everything full circle, while you still may be hesitant to ask your policyholders for new reviews for fear of receiving a negative one, I would encourage you to start simple. Ask your satisfied customers who have been with your agency for several years to leave a review. When you bind a new policy, ask that customer to leave a review. Take advantage of key moments during the customer journey to ask for reviews, in situations where you can be fairly certain that your policyholders have had a positive experience thus far.

How BrightFire Helps Insurance Agents with Online Reviews

With all that said, when it comes to protecting your online reputation, monitoring your profiles, and generating new reviews like we’ve discussed today, we know that managing each platform and responding to each review can be overwhelming.

That’s where BrightFire’s Reviews & Reputation Management service is available to help take the burden off of you so your agency can more easily grow, nurture, and protect your online reputation.

With the support of our digital marketing experts, your agency will be able to generate new reviews with ease, improve your SEO rankings, and gauge your customers’ happiness.

We provide everything you need to successfully manage your online reputation, including:

- The creation and management of review profiles.

- Professional agency branding on review profiles.

- Two BrightFire-managed review generation campaigns each year.

- Two BrightFire-managed Net Promoter Score (NPS) surveys each year.

- Unlimited individual & broadcast review requests via text message & email.

- Ongoing review monitoring and management.

- Option to automatically share new positive reviews to Facebook & Instagram.

- Optional automated customizable review responses.

- A convenient, user-friendly dashboard.

- And coaching on best practices for online reviews.

Online Reviews & Your Overall SEO Strategy

But our support doesn’t stop there. We mentioned positive online reviews can improve your website’s SEO and strengthen your agency’s rankings in the search results.

But improving your local SEO efforts through online reviews is really just scraping the tip of the iceberg. To really make an impact and take advantage of everything your agency needs to rank in Google, BrightFire’s Ultimate SEO Bundle is available.

In addition to getting the benefits we mentioned on the last slide pertaining to our Reviews & Reputation Management service, you’ll also get an amazing custom-designed agency website that’s optimized to rank in search engines, as well as attract and convert more insurance buyers online.

And because consistent and accurate information on key search engines is the foundation of local search success, the Ultimate SEO Bundle also includes our Local Listings Management service. This service helps your agency get found across the web on more than 50 of the most important listings so consumers can reach you, with or without visiting your website.

The best part is that when you sign up for the Ultimate SEO Bundle, you’ll save on the standalone prices of each of those three services.

How to Get Started with BrightFire

If you’re new to BrightFire and would like to take advantage of our services, you can sign up for BrightFire’s Reviews & Reputation Management service for only $95 per month.

If you’re interested in taking advantage of BrightFire’s Ultimate SEO Bundle to cover all of your SEO bases and help your agency attract new insurance buyers, you can do so for just $210 per month. As a reminder, that includes our Reviews & Reputation Management, Insurance Agency Websites, and Local Listings Management services, and saves you $50 per month off the standalone prices.

Our digital marketing services don’t have any setup fees or contracts and also include a 30-day money-back guarantee.

Onboarding typically consists of one 30-minute phone call, and your Reviews & Reputation Management services are usually live within a week of the onboarding call.

As a thank you for attending today, we’re offering a $50 promo to webinar attendees. You can receive a $50 account credit for signing up for our Reviews & Reputation Management or Ultimate SEO Bundle services. This promo ends next Wednesday, October 4th.

To get started with BrightFire, please schedule a call with us. On our website, you can submit your purchase, start a live chat with us, or schedule a call with a BrightFire expert.

Q&A on Insurance Online Reviews

That concludes our presentation on Debunking 5 Myths About Online Reviews for Insurance Agents. Now we’ll head into our Q&A session, if anyone has any questions!

As a reminder to our attendees, we’ll do our best to answer any questions that come through. If we aren’t able to address your question during the webinar, someone from BrightFire will follow up with you via email to answer your question.

If we have online reviews more than a year old, should we still go back and respond to them?

Great question, and yes! Even though it may seem unnecessary, future prospects may still come across that review. In your response, I recommend acknowledging the gap in response time, thanking them for their review, addressing any concerns, and then reassuring them that your agency is actively working on improving your online presence to best engage with your customers and improve the service you provide. When you respond to old reviews, as well as begin to consistently respond to new reviews, it will show consumers browsing your profiles that your agency is now active online, attentive to feedback, and improving your engagement with customers.

How would you respond to a negative online review?

Another great question! So, we mentioned earlier that it’s really important to thank them for their feedback and address their concerns. You also want to share what consumers can typically expect from your agency, and then try to take the conversation offline to best resolve the issue.

As an example, say you get a negative review that mentions they never received a call back from your agency. You might respond with something like, “Thank you so much for your feedback, and I’m sorry to hear you never received a callback. Every customer is a priority to us, and we strive to respond within 24 hours to every voicemail we receive. We would appreciate a second chance to provide you with affordable coverage for your insurance needs. Please give us another call or email us and we will get back to you ASAP.”

Well, I think that is all the time we have for questions today. Thank you to everyone who submitted a question.

Upcoming 20 Minute Marketing Webinars

That wraps up our webinars for 2023. We’ll be taking a break for the holidays and ramping back up in January of 2024.

Until then, I encourage you to continue learning by checking out all of our webinars in the 20 Minute Marketing Series and watching any that you may have missed. You can view any of our webinars on-demand through our website at brightfire.com/webinars.

So that does it for today! From me and the rest of the BrightFire team, we’d like to thank all of you for attending.