It’s important for your independent insurance agency to know what policyholders are saying online about your agency so you can stay on top of consumers’ minds while standing apart from the competition.

View BrightFire’s latest 20 Minute Marketing Webinar as Sales Advisor Spencer Breidenbach shows you how to analyze your agency’s current online reputation and offers pragmatic steps to effectively manage your online reviews so you can improve policyholder satisfaction, consumer engagement, and lead generation.

What to expect from this webinar:

- What is online reputation management

- Why and how to assess your online reputation

- How to take action to improve your online reputation

Finally, Spencer details how BrightFire’s Reviews & Reputation Management and Social Media Marketing services offer everything your independent insurance agency needs to manage, improve, and protect your online reputation.

Watch The Webinar

Additional Questions?

If you have any questions about this webinar or about BrightFire’s Reviews & Reputation Management or Social Media Marketing services, please contact us.

Webinar Transcript

Chelsea: Hello everyone! My name is Chelsea Peterson, and I’m a Digital Marketing Coordinator here at BrightFire, as well as your host for today’s 20 Minute Marketing Webinar. Thank you all for joining us.

Last month, we covered Common Insurance SEO Myths Debunked. If you missed it, or any of our previous webinars in the 20 Minute Marketing Webinar series, you can access the whole series on-demand by visiting brightfire.com/webinars.

Our goal with these webinars is to provide you with digital marketing advice and discuss current digital marketing topics in a brief 20-minute format followed by a Q&A period to answer any questions you may have. If you have questions during the webinar, please use the Q&A feature in Zoom found at the bottom of the screen. We’ll do our best to answer all of the questions that come through; otherwise, we will personally reach out to you afterward.

Today’s webinar topic is The 3 A’s of Reputation Management for Insurance: Awareness, Assessment, & Action, and it will be presented by Spencer Breidenbach, one of our Sales Advisors here at BrightFire.

It’s important for you to know what policyholders are saying online about your insurance agency so you can stay on top of consumers’ minds while standing apart from the competition. So today Spencer will show you how to analyze your agency’s current online reputation and offer pragmatic steps to effectively manage your online reviews so you can improve policyholder satisfaction, consumer engagement, and lead generation.

Today’s webinar is being recorded, so everything we discuss will be saved and emailed to you in the next business day or two so you can watch it later on-demand.

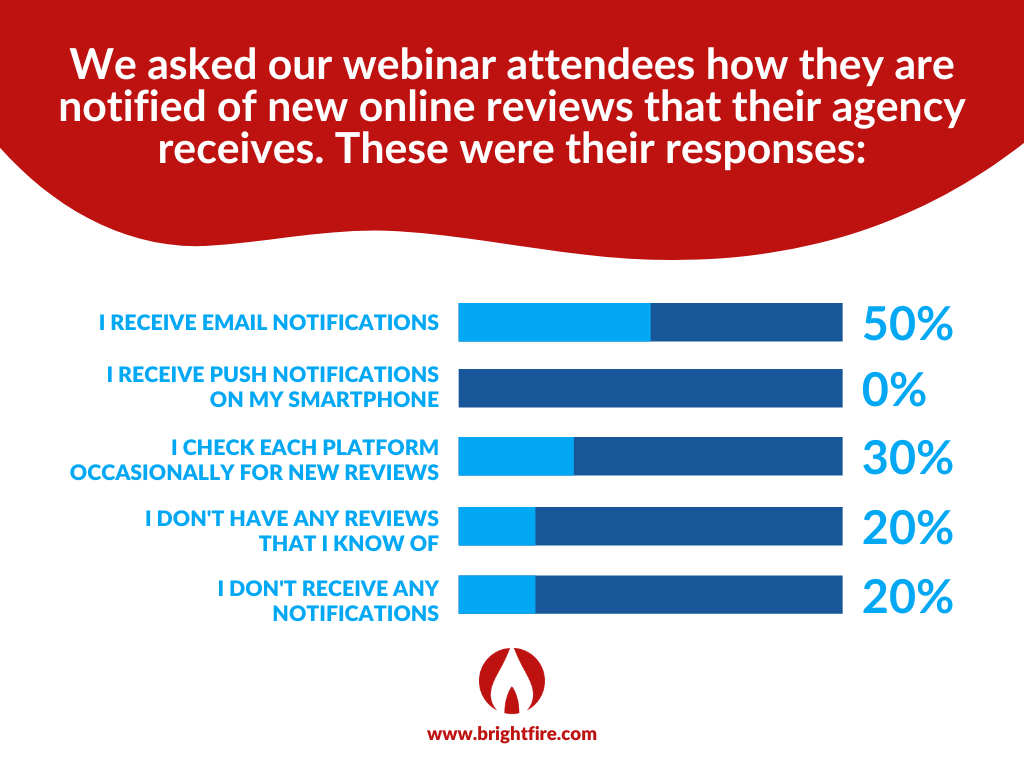

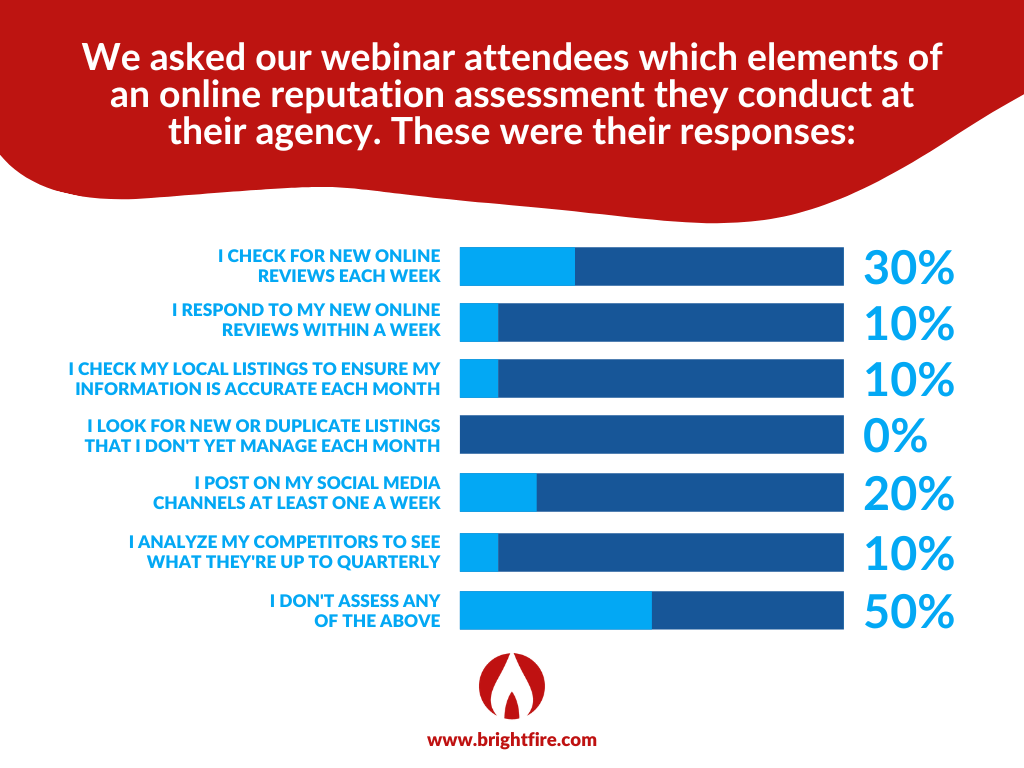

Lastly, we do have a couple of polls for today’s webinar. When launched, you’ll see the poll pop up on your screen with the question and multiple-choice options. You can select more than one response, and every poll is anonymous. We’ll give you roughly 30 seconds to share your response, and then we’ll discuss the results with the group.

With that being said, I’ll go ahead and hand it over to Spencer to kick off today’s webinar.

What’s Ahead

Spencer: Thanks, Chelsea, and thank you to everyone joining in. As you may experience in your own agency, it can be difficult to find the time to work to improve your online reputation. Many times, an agency only focuses on their online reputation when an issue arises, such as receiving a negative online review.

So the first A of reputation management that we will discuss in today’s webinar is focused on helping agencies become aware of what online reputation management means and why it’s so important to have a plan in place to consistently monitor and manage your online reputation.

Then, we’ll go over how you can conduct an audit and assess your current online reputation to see where your agency stands against the competition. We’ll discuss a handful of categories to assess, including your local business listings, review sites, and your social media channels, as well as those of your competitors. From those results, we’ll dive into some actions you can take to improve your online reputation and how you can effectively manage it on an ongoing basis.

Finally, I’ll cover how BrightFire can help you manage, improve, and protect your online reputation with our Reviews & Reputation Management service. Our Social Media Marketing service can also help you maintain the social media aspect of your online reputation.

The First “A” of Reputation Management: Awareness

So, as I mentioned previously, the first “A” of reputation management is awareness. Simply put, your company’s online reputation is defined as how others perceive your agency online. For example, when someone finds your agency in a search on Google, do they have an overall positive or negative impression of your agency? Do your customer reviews make you look credible and trustworthy online? Would a prospect feel confident about doing business with your agency? These are just a few important considerations to take into account when analyzing your online reputation.

Studies have shown that online reputation makes up over 25% of a brand’s market value, so it’s vital to consistently monitor and manage it. Improving your online reputation can also increase trust in your agency, which leads to increased customer loyalty and retention. Your online reputation can also improve your rankings on Google and other search engines, as well as grow your sales and overall book of business, giving you a stronger competitive advantage.

Your online reviews act as social proof that your agency is credible and trustworthy, delivering on the promises you make to your customers. When prospects read positive reviews – and they will read them, because roughly 95% of customers make sure to read reviews before making a purchase – they will begin to believe that you will actually meet their needs and expectations.

But just having a few online reviews isn’t enough. In fact, keeping a steady stream of new reviews coming in is really important, since 85% of consumers believe local reviews older than three months are irrelevant. While older reviews are still vital to your online reputation as a whole, newer reviews tell prospects that your agency is more likely to offer the same high-quality services and customer experiences for them as well.

There is more to your online reputation than positive reviews, such as having an agency website that is secure and professionally designed, as well as posting regular content to your website’s blog and social media profiles. For the purpose of this webinar, though, we will focus on monitoring and managing your online reputation through the channels you receive reviews from such as your local listings and social media profiles.

Now that we’ve covered what online reputation management entails and why it’s so important, let’s move on to the next A of reputation management.

The Second “A” of Reputation Management: Assessment

The second A of reputation management is assessment. Conducting an assessment or audit of your online reputation can give you a clearer picture of what your agency is doing really well, where you can improve, and what your customers are expecting from your team.

So, what kind of profiles and sites should you look at during this assessment? Let’s go over a few important local business listings first, which include Google My Business, Bing, and Yelp. The first item to check is whether you have claimed each listing. Let’s look at these two Yelp listings as an example.

One listing shows they have claimed their listing, while the other highlights a section asking the person viewing the listing to claim the listing if it’s yours. Leaving listings unclaimed is a missed opportunity and doesn’t reflect well on your agency in the eyes of consumers.

The next item to assess is what business information you need to complete or update on each listing. For example, have you added a short bio about your agency, all of your contact information, and your website URL, as well as photos that represent your agency well?

After checking the accuracy of each listing’s information, take a look at the reviews section. Take stock of how many reviews each platform has, what your overall rating is, and whether there are any reviews that your agency hasn’t responded to.

It’s also essential to pay attention to what your policyholders like most about your agency, as well as what may need improvement. This will be vital information when your agency is ready to take action on improving your online reputation based on this assessment.

Now, moving onto the next category of your online reputation to assess – your social media channels. Similar to local listings, you can have unclaimed Facebook and LinkedIn accounts that were automatically created for you. Unclaimed social media profiles will lack branding and may have incorrect business information. Search for your agency’s name on Facebook and LinkedIn and look for any pages or profiles that you need to claim.

Then, take note of whether each page is properly branded. Take these two accounts as examples of great branding. They both have their logo as the profile image, and one has included their logo on their cover image, and the other does a really nice job of incorporating their brand colors and logo into each Instagram post.

When you’re analyzing your social media channels, note any opportunities to incorporate your brand image even more. You’ll also want to confirm all of the sections are filled out and accurate, including your contact information and bio. Then, take stock of how many followers each account has, as well as how often you post on average on each channel, the engagement you generally receive on each post, how many direct messages you’ve received, and whether your agency responded to messages and comments.

Are there accounts that you have that you never post on, don’t have a great following on, or that you don’t have the time to commit to managing?

The last category of your online reputation assessment is to audit your competitors. Repeat the last few steps for your competitors’ pages. Pay attention to what they are doing well, as well as where they can improve. Is there an opportunity for your agency to fill a gap that your competitors might be creating in their service offerings or how they deliver on their customer experience? Knowing more about your competition and what their customers like and don’t like about their agency can give you a lot of insight to improve your agency’s marketing efforts.

The Third “A” of Reputation Management: Action

Let’s go ahead and dive into the last of the 3 A’s of reputation management – action. This last step is arguably the most important, yet the easiest to forgo because of the effort it may take to effectively execute. Given everything you’ve uncovered through assessing your online reputation, you’ll undoubtedly have a number of areas for improvement and some ideas about how to take your online reputation to the next level.

First and foremost, you need to be proactive rather than reactive by claiming and filling out all of the local business listings or social media profiles you found that are unclaimed. This includes sites such as Yelp, Google My Business, Better Business Bureau, Facebook, LinkedIn, etc.

Next, categorize your negative and positive reviews, and determine what people like about your agency, as well as what people say needs improvement. While poor reviews help your agency learn and grow, positive reviews will also give you insights into your agency’s strengths that you can leverage in your messaging to better market your agency. If you do nothing with your reviews, you’ll miss out on a lot of opportunities to improve your reputation both online and offline.

Make the decision to start responding to your reviews if you haven’t in the past. While 75% of businesses don’t respond to their online reviews, doing so can help you stand out from the crowd and also better engage your prospects and customers. This is because a whopping 89% of customers take the time to read businesses’ replies to reviews, perhaps to see how issues were resolved or to gain a better picture of how the company speaks to customers.

When responding to a poor review, don’t let the negative comments get the best of you. Apologize for the customer’s experience and offer a way to resolve their situation. Remember, when you are responding to a negative review, your audience includes potential customers as well. For example, you could say something like, “Hey John, we are so sorry you received poor customer service. We’d love to hear more about your experience and help however possible. Please give us a call so we can discuss further.” Once you’ve spoken with the customer and they are happy with your agency’s resolution, you can ask them to consider updating their review. Many times individuals are more than willing to do this when asked.

Don’t forget to respond to positive reviews as well. Doing so can enhance the reviewer’s customer experience by showing appreciation for the effort they took to write it. It also shows people who later see your accounts and reviews that you are active and responsive.

Now is also a good time to consider if there are opportunities to highlight what your customers mentioned in their positive reviews more in your marketing. By promoting what your policyholders enjoy most about your agency, you’ll be able to strengthen your social proof, as your marketing messaging will better align with what prospects read in customer reviews.

This new standard will also help you determine what aspects of your negative reviews you should work on improving first. For example, if customer service is one of your key strengths, and you see the last few reviews mention poor customer service, then you’ll want to address that issue first to keep your online reputation aligned with the benefits you’re telling consumers they can expect from your agency.

The next action you should take is to actively seek out new reviews. Studies show that up to 80% of reviews originate from businesses sending follow-up emails urging their customers to review their purchases.

One simple way to ask for reviews is through Net Promoter Score or NPS surveys. This is a one-question survey that asks customers, “How likely is it that you would recommend our agency to a friend or colleague?” on a 0 to 10 scale. At BrightFire, we send these surveys to our clients’ policyholders twice a year. Once a customer rates your agency, they’ll be given the opportunity to leave text feedback with any additional remarks. They’ll also be prompted to consider leaving a public review on popular review networks like Google and Facebook. These NPS and review generation campaigns are just one easy way your agency can easily increase your online review count and improve your overall star ratings.

If you’re interested in more helpful tips and everything you need to know about your agency’s online reviews, you can check out our Ultimate Guide to Online Reviews at brightfire.com/ultimate-guide-reviews.

When it comes to taking action on improving your online reputation through your social media channels, make a content calendar so you can keep up with the dates you should be posting and to help you brainstorm ideas for future posts. Social media networks give more visibility to the accounts that are more active and post consistently, so plan to post on each account at least once per week. Set aside a time that works best for you to plan and schedule content ahead of time. If you don’t have time for this, BrightFire can help by writing and posting content to your social media sites each week as part of our Social Media Marketing service.

You should also make sure you have your notifications set up properly for your social media accounts so that you can engage with your followers and respond to any direct messages your agency’s page may have received in a timely manner.

The last action item for today from our online reputation assessment is to beat the competition at their own game. After finding out what consumers are saying about your competitors, take any actions possible to offer consumers more value, such as providing customer service through a number of networks like Google My Business Messaging, Facebook Messenger, or live chat on your agency website. It’s important to respond quickly on these messaging platforms. For instance, if you enable Google My Business Messaging and fail to respond within 24 hours repeatedly, Google will revoke the ability of your business to use their messaging feature.

The next few items are simple actions you can take to improve your online reputation as a whole. First, set your prospects up for success by providing them with clear expectations. How quickly can they expect to hear back from you or start a new policy with your agency? Should they expect you to communicate to them through an email, call, or text? Underpromise and overdeliver.

You should also delegate the different tasks related to your online reputation if possible. Who should be in charge of checking for new duplice local listings? Who should respond to online reviews? Who should initiate and manage any efforts of receiving new reviews? Making sure these tasks are taken care of on an ongoing basis is essential to the success of your online reputation management strategies.

And finally, remember that your online reputation is not a one-time effort. You have to consistently manage it. There will always be room for improvement for even the best agencies, so remember to prioritize, improve, and repeat the cycle of staying aware of where your agency is showing up online, assessing customer reviews and your online reputation as a whole, and taking action to improve upon any problem areas.

How BrightFire Helps with Reputation Management

I realize that was a lot of information and that it can seem very daunting to develop and maintain a consistent and effective online reputation management strategy. That’s why BrightFire’s Reviews & Reputation Management service is designed to take the burden off of you and help your agency easily grow, nurture, and protect its online reputation.

Our digital marketing experts can review your agency’s current online reputation, offer tips and practical advice to help you improve it, and take care of the heavy lifting for you, so you can focus on selling insurance and growing your business.

We provide everything you need to successfully monitor, manage, and grow your online reputation on the most important review networks, including:

- A Convenient Reputation Management Dashboard

- Two Managed Net Promoter Score (NPS) Surveys Each Year

- Review Monitoring

- Review Generation Campaigns

- New Review Alerts

Our Social Media Marketing service can further help with your agency’s online reputation by professionally branding your social media accounts and publishing helpful content related to the types of insurance you sell multiple times per week.

Once enrolled into our Social Media Marketing service, you’ll receive:

- Professional Branding

- Up to 31 posts per month

- A Rapidly Built Audience

- A Consolidated Social Media Dashboard

- Metrics Reporting

- Custom Campaigns Available for an additional fee

How to Get Started with Reputation Management

Spencer: So how can you get started? BrightFire’s Reviews & Reputation Management service only costs $80 per month.

Additionally, our Reviews & Reputation Management service is included in our Ultimate SEO Bundle along with an Insurance Agency Website and our Local Listings Management service. This bundle costs $190 per month and saves your agency $30 per month off of the standalone prices.

Our Social Media Marketing service costs $80 per month as well. You also have the option to purchase additional custom campaigns for $60 per month per custom campaign desired. An example of a custom campaign includes promoting contests you’re running online or highlighting a local event your agency is involved in.

None of our digital marketing services have any setup fees or contracts, and we also include a 30-day money-back guarantee.

Our onboarding process is designed to take the burden off of you as much as possible and generally consists of one 30-minute phone call. Typically, we can launch our Reviews & Reputation Management service or our Social Media Marketing service within about a week of signing up.

As a thank you for attending today, we’re offering a $50 promo to webinar attendees. You can receive a $50 account credit for signing up for our Reviews & Reputation Management service or our Social Media Marketing service. This promo ends next Wednesday, August 4th.

To get started with a successful reputation management strategy managed by our digital marketing experts, please schedule a free consultation.

Q&A on Reputation Management

Spencer: That concludes our presentation on The 3 A’s of Reputation Management for Insurance: Awareness, Assessment, & Action. I’ll now pass it over to Chelsea to start the Q&A session if anyone has any questions!

Chelsea: Great. Thank you, Spencer! As a reminder to our attendees, we’ll do our best to answer any questions that come through. If we aren’t able to address your question during the webinar, someone from BrightFire will follow up with you via email to answer your question. Let’s get started.

Should I go back and respond to my old reviews?

Spencer: That’s a great question. You should respond to any and all reviews that are less than a few years old. While responding to Joe Smith’s negative review from three years ago won’t help you win him back as a policyholder, it can still be beneficial to respond knowing future consumers may want to look through your reviews and see responses from the owner.

Do people really care about how old my reviews are as long as I have 4.9 stars on Google?

Spencer: Another great question. This goes back to what we discussed earlier about assuring consumers that they will receive the same great service they read about in your reviews. Thinking about the statistic I mentioned earlier, the vast majority of people believe that reviews older than three months are irrelevant. Over the years, your team and services change and so will the experiences people have with your agency. Even if you still provide the same level of service, it’s important to help consumers feel more confident about that fact with a constant stream of new reviews reaffirming outstanding customer experience.

Chelsea: Awesome, thanks, Spencer! Well, I think that is all the time we have for questions today. Thank you to everyone who submitted a question, and again, we’ll follow up with you individually after the webinar if we didn’t get to your question today.

Before we close, I’d like to remind everyone of our upcoming 20 Minute Marketing Webinars.

Upcoming 20 Minute Marketing Webinars

Chelsea: Our next webinar in August is, “Unlock the Power of Engagement in Insurance Social Media Marketing.”

In today’s digital age, there’s no question that social media should be a part of your digital marketing strategy. But to truly increase brand trustworthiness and loyalty, your agency should go above and beyond simply being present and occasionally posting on social media.

Join us in this webinar as we dive into how engaging with followers on your social media channels can have a substantially positive impact on your brand and book of business.

This webinar will be held Thursday, August 26, at 2:00 p.m. Eastern or 11:00 a.m. Pacific.

Finally, our webinar in September is, “Humanize Your Website & Boost Sales With My Agent Personalization.”

As an independent agency owner, you understand building relationships with policyholders and prospects is crucial to growing your book of business. Now more than ever, it’s important to maintain those same personalized experiences on your agency’s website.

In this webinar, we’ll unpack what BrightFire’s My Agent Personalization tool is and how your agency’s sales team can leverage it on your Insurance Agency Website to improve your customer experience, increase efficiency, and boost your agency’s sales.

This webinar will be held Thursday, September 30, at 2:00 p.m. Eastern or 11:00 a.m. Pacific.

You can reserve your spot at these webinars by visiting the webinars page on our website at brightfire.com/webinars.

So that does it for today! From me, Spencer, and the rest of the BrightFire team, we’d like to thank all of you for attending.