Studies show that 71% of consumers who have a positive experience with brands on social media are likely to recommend them to friends and family. With 70% of insurance companies already using social media to reach consumers, it’s imperative your agency is leveraging your channels to increase brand awareness, build customer relationships, and drive business growth.

In our latest 20 Minute Marketing Webinar, Manager of Marketing Chelsea Peterson shared BrightFire’s 6 P’s of insurance social media marketing to propel your agency to new heights of success. From pinpointing your purpose to paying attention to metrics for consistent improvement, she explored strategic tips that can help elevate your online presence and strengthen your bottom line.

BrightFire’s 6 P’s of Insurance Social Media Success

Watch the webinar, read through the full transcript, or jump ahead to the section you’re most interested in to discover BrightFire’s 6 P’s of insurance social media success.

- Pinpoint Your Purpose

- Pick Your Platforms

- Prepare Your Process

- Plan Your Content

- Publish & Engage

- Pay Attention

Watch the Webinar

Additional Questions?

If you have any questions about what we discussed in the webinar or BrightFire’s Social Media Marketing service, please schedule a call with sales.

Webinar Transcript

Welcome everyone! My name is Chelsea Peterson, and I’m the Manager of Marketing here at BrightFire, as well as your host for today’s webinar. Thank you all for joining us.

In January, we covered Transform Your Agency’s Referral Marketing with BrightFire. If you missed it, or any of our previous webinars in the 20 Minute Marketing Webinar series, you can access the whole series on-demand by visiting brightfire.com/webinars.

Our goal with these webinars is to provide you with digital marketing advice and discuss current digital marketing topics in a brief 20-minute format followed by a Q&A period to answer any questions you may have. If you have questions during the webinar, please use the Q&A feature. We’ll do our best to answer all of the questions that come through; otherwise, we will personally reach out to you afterward.

Today’s webinar topic is The 6 P’s of Insurance Social Media Success. Studies show that 71% of consumers who have a positive experience with brands on social media are likely to recommend them to friends and family, so it’s imperative your agency is leveraging your channels to increase brand awareness, build customer relationships, and drive business growth.

So today, we’re going to dive into BrightFire’s 6 P’s of insurance social media marketing that will help propel your agency to new heights of success. We’ll also explore strategic tips that can help elevate your online presence and strengthen your bottom line.

Today’s webinar is being recorded, so everything we discuss will be saved and emailed to you in the next business day or two so you can watch it later on-demand.

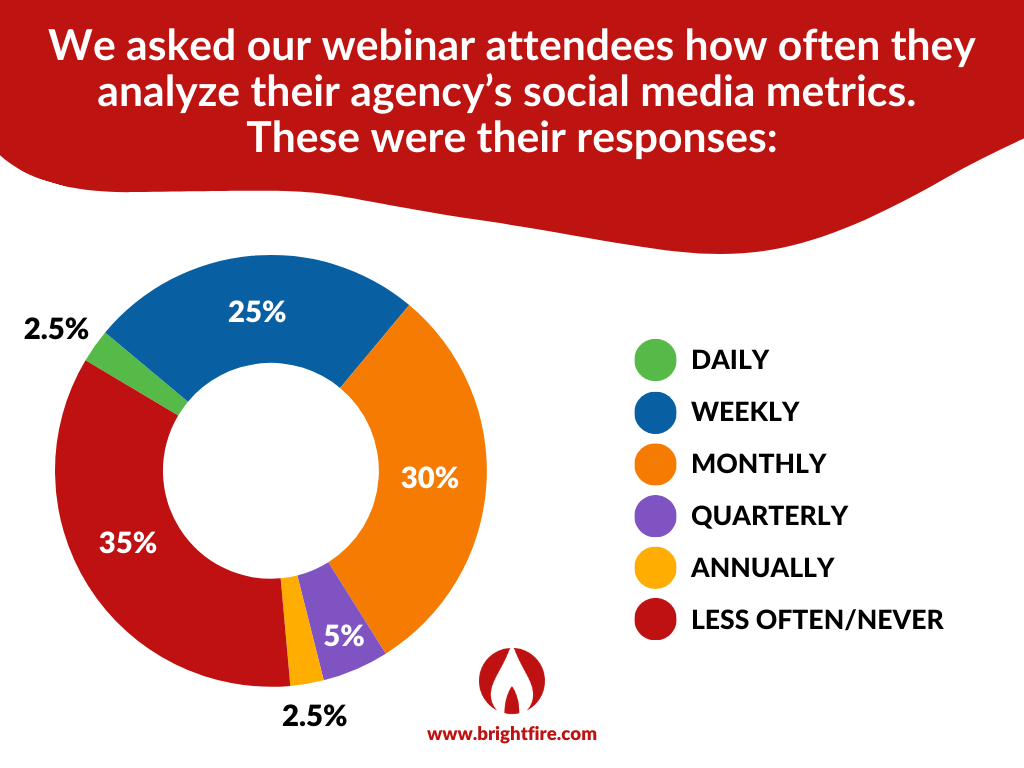

Lastly, we do have a couple of polls for today’s webinar. When launched, you’ll see the poll pop up on your screen with the question and response options. Every poll is anonymous, and I’ll give you roughly 30 seconds to share your response, and then we’ll discuss the results with the group.

About BrightFire

Before we dive into today’s topic, I’d like to share a brief background on BrightFire, since we have a mix of current customers and agents that are new to BrightFire attending today.

So BrightFire began by providing insurance agency websites in 2000. And over the years, as the digital marketing needs of insurance agents grew beyond just agency websites, we added new services, including:

- Search Engine Optimization

- Local Listings Management

- Reviews & Reputation Management

- Pay-Per-Click Advertising

- Social Media Marketing

With any of our services, our goal is to really make it as easy as possible for your agency. So everything we do, from onboarding and setup to providing customer support for years to come, has a done-for-you approach that’s focused on taking the burden off of your agency. Our digital marketing experts set up and manage everything for you with all of our services, so you can save time, focus on what you do best, and grow your business.

Currently, we work with over 2,500 agencies across the nation, and our first agency customer in 2000 is still a BrightFire customer today.

With that background on BrightFire, let’s get started.

What’s Ahead

I mentioned earlier the high likelihood that consumers will refer brands to friends and family if they have a positive experience with them on social media. But to take it a step further, studies also show that more than 70% of independent insurance agents report using social media in their marketing efforts (Agent for the Future).

And with consumers spending an average of 2.5 hours per day on social media and messaging platforms (DataReportal), your agency has a huge opportunity to stay top of mind with your current policyholders and get in front of your ideal audience to build credibility and trust as a thought leader in the industry.

The key is to get strategic with how you’re being active on your channels so you can maximize the results you’re getting from the effort and time spent on social media. And that’s where BrightFire’s 6 P’s of insurance social media success come into play that we’ll be talking about today, which are:

- Pinpoint Your Purpose

- Pick Your Platforms

- Prepare Your Process

- Plan Your Content

- Publish & Engage

- Pay Attention

After we dive into each of these points, we’ll also talk about how BrightFire’s Social Media Marketing service is available to take care of most of these steps for your agency so you can save time and really focus on engaging and building relationships with your policyholders and prospects.

BrightFire’s 1st P of Insurance Social Media Success: Pinpoint Your Purpose

So the first P is to pinpoint your purpose. Before anything else, it’s so important to take a step back and look at the bigger picture of why you’re on social media. Without a goal, your content will lack focus, and you may struggle to truly connect with your audience.

I’m sure for everyone on this webinar, your first instinct is to say, “My goal is to sell more insurance.” Unfortunately, I’d be very surprised if any agent found that when they get a new follower on Instagram, they immediately bind a policy because of a post they published. So, to really be successful on social media, you need to break that goal down further.

For example, a recent Statista study found that 86% of businesses say increased brand exposure is an advantage of social media marketing, and 76% of businesses say social media is great for increasing traffic to their website.

So, if you decide your main purpose of being on social media is for brand awareness and increased website traffic, then you can add your website to your profile on each platform, and publish posts often that link to your website to get a quote, read a blog, or view your awesome customer reviews.

Another great option for your purpose could be to build stronger relationships with your customers. Many times, consumers will follow companies they purchase from or interact with through social platforms. Because of this, your agency could promote your social media channels on your website, email signature, and business cards to make your customers aware of the platforms you’re on. You could even send out email campaigns asking policyholders to engage with you on social media.

Not only is this a great way to get more followers, but it will help you stay top of mind with your policyholders as they engage with your posts and potentially learn about additional coverage options they should consider.

BrightFire’s 2nd P of Insurance Social Media Success: Pick Your Platforms

So, once you have a clear understanding of why your agency is on social media, the next step is to pick which platforms you’ll be present on. It’s easy to think that you should have an account for every platform there is, such as Facebook, LinkedIn, Instagram, Google Posts, X, formerly known as Twitter, and even TikTok.

But choosing to be active on all of the platforms can be overwhelming and actually hurt your brand reputation. That’s because social media often acts as an extension of your agency’s customer service. People may comment on your posts asking questions or send your agency a direct message through one of your platforms. And if you’re not able to effectively manage all of the social media accounts you set up, then you may be ignoring important messages from current or potential customers.

So, consider what your agency can actually manage and focus on quality over quantity. If you decide to only be on Facebook and LinkedIn, choose to be very active and engaged on those two platforms. And, if you decide later you can manage more, then you can create a new account on another platform.

But which platforms should your agency be present on? Generally speaking, Facebook is the most widely used platform, with 69% of adults reporting that they use Facebook (Marketing Charts).

For LinkedIn, the largest age group used to be more geared toward older generations, but is now closer to Facebook at 25-34 years old (Staff Boom). It’s also a great platform for reaching and connecting with other businesses.

Instagram is the top platform for brands to build relationships with the Gen Z and Millennial populations.

While you may not think of Google as a social networking site, it’s a platform where you can connect with insurance consumers through your agency’s Google Business Profile while they are researching online.

With all of the recent changes to X, formerly known as Twitter, there is expected to be a dip in the overall growth and engagement on the platform, so it may not be one to prioritize for your agency.

And finally, TikTok has quickly experienced huge growth, but the most active users are between 10 and 19 years old, and it requires your agency to consistently create videos in order to be successful.

All in all, the platforms your agency chooses to be present on should be based on where your audience is most likely to be active and engaged with your brand, as well as what your agency can effectively manage.

BrightFire’s 3rd P of Insurance Social Media Success: Prepare Your Process

Once you know what platforms you’re going to post on, it’s time to prepare your process. It can be easy to look at social media as just something you get around to doing if you have an extra moment in your day. But by creating a process and streamlining the different tasks associated with crafting your content and scheduling it ahead of time, you can save time and make social media something that’s much more easily a normal part of your digital marketing strategy.

First and foremost, I recommend creating a content calendar. This doesn’t have to be anything fancy using a paid platform. You can create a normal calendar using a free site like Google Sheets. By having a content calendar, it will be easier to plan how many days per week you want to post on social media, as well as what topics your posts should focus on.

Another reason I recommend leveraging content calendars is because they can help you reduce writer’s block and create batches of content for the entire month. Say you have an hour to spend one day on social media. If you already have a content calendar created and know when and what topics you’re going to post about, you can more easily create and schedule several posts in one sitting.

Next, you’ll need to decide how you’ll schedule your posts in advance. We recommend scheduling over posting in real-time so you don’t have to worry about remembering to post on a specific day or time.

Does it make sense for your agency to schedule posts for free within each individual platform? This can be time-consuming, and they often have restrictions, such as not being able to schedule content further in advance than a month. If you want to save time, there are also some platforms you can use, and often pay for, that allow you to schedule posts on multiple platforms at the same time.

Finally, taking your goals into account, you should consider how your agency will measure success on social media. We’ll talk more about which metrics you should pay attention to later, but for the purposes of preparing your process, it’s important to keep in mind that you should think through the metrics that will help you know whether you’re on the right track to achieving your goals.

BrightFire’s 4th P of Insurance Social Media Success: Plan Your Content

Now that you have a process in place and a content calendar created, the next step to insurance social media success is determining what content to write.

While the individual types of insurance your agency focuses on, like auto insurance, workers’ comp, Medicare, life insurance, or group benefits, may differ, the overall categories should be consistent for any insurance agent on social media.

The first category is creating educational content. This is the bread and butter of your channels where you’ll talk about the different policies you sell and why it’s crucial for your audience to consider purchasing those types of coverage. You can provide statistics and relevant research on the subject, explain the benefits and needs for that coverage, debunk common misconceptions about a certain policy, and promote your educational blog posts with a link for your followers to read the full article on your website. This is your space to become a thought leader in the industry, show your expertise on the subject, and build trust and credibility with your policyholders.

The next category of content is inspirational content. Posts in this category may showcase your community involvement and inspire your policyholders to get out in the community and serve. They may offer customer reviews of people who were thankful they had that coverage when they needed it the most. You might even share a famous quote that inspired you or a book you’re reading to grow personally or professionally. With inspirational posts, you should tag relevant companies your content mentions to gain visibility and start a conversation with that account.

The final category of content is entertaining content. This is the area where you’ll be able to stand out from the rest of the industry and humanize your brand. Maybe one of your agents likes to pull pranks on others, or you have a pet that frequently visits the office. Take a quick video of some behind-the-scenes footage in your office and publish it to social media. These types of posts often get the most likes, comments, and shares because they are entertaining, and they also help insurance consumers feel more connected with your agency.

You could also ask your followers questions about their favorite outdoor activities, create a poll to get your followers’ opinions about a relevant national day or celebration, or simply provide holiday greetings with a fun or sentimental note from your office.

Whatever content you write, be sure to add relevant hashtags. Whether you use #HealthInsurance on an educational post or #GirlScoutCookies on a post about your agency’s support for a local Girl Scout, hashtags can significantly increase the visibility of your social media posts.

BrightFire’s 5th P of Insurance Social Media Success: Publish & Engage

Once you publish your content, it’s time to engage with your followers on each account. This is probably the easiest step to ignore because it can feel way too time-consuming. However, it can also make a huge difference in the success of your social media accounts.

Once a post is published, it’s best practice to scan through your social media feeds and like or comment on your followers’ posts. Then, when you get comments on your posts, be sure to like the comment and respond to it, whether that be to say thanks, answer a question, or continue the conversation in some way.

Because social media is meant to be social, algorithms often boost the content of accounts that are more engaged with their followers and create conversations, rather than the accounts that simply post and ignore their profile and their followers.

Another crucial aspect of engaging on social media is routinely checking your direct messages and responding in a timely manner. Speed is key here, since 42% of customers expect a response within an hour and 32% expect a response within 30 minutes (Convince & Convert). I know that it can seem daunting to try and meet those expectations, but fortunately, several platforms allow you to set up auto-replies when you receive a message.

For example, if you can’t properly manage your Facebook inbox, you can set up an automatic response to let consumers know that your Facebook inbox is not routinely monitored and that instead, they can receive a quicker response if they call or email your agency. By setting this up rather than ignoring your inbox altogether, you can still strengthen trust and loyalty with your followers.

If engaging with your followers seems like too much to add to your plate, I recommend trying to divvy up the work within your agency, and also make it a part of your overall strategy and process. For example, if you have multiple people on staff, you could alternate who monitors your agency’s social media each day or give each team member a different platform to monitor. If it’s just you in your agency, you could choose to spend just five minutes a day engaging with your accounts.

However you choose to do it, I recommend you set up push or email notifications to ensure you know when someone comments on a post or messages your agency. That way, even if you aren’t able to spend time on your newsfeed engaging with your followers, you can at least make sure people who leave a comment or message receive a timely response.

BrightFire’s 6th P of Insurance Social Media Success: Pay Attention

But social media success doesn’t end at publishing content and engaging with your followers. Our last P for today is paying attention to your social media metrics, which can help your agency improve and discover what your ideal audience wants to see from your agency.

To effectively analyze your social media metrics, we need to go back to our first point for today and consider your purpose. If growth was one of your goals, you’ll want to make sure you track your follower counts. If you want more brand awareness, you should also check your engagement numbers, such as likes, comments, and shares, for each post.

If you notice that no one ever engages with your #MondayMotivation posts in the inspirational category, but people love seeing your testimonials and the books you’re reading to grow personally, then take note of that in your content calendar and consider dropping the #MondayMotivation posts.

You should even keep track of how many posts you publish within a given timeframe, as well as which days and times of the week typically gain the most impressions and engagement. This will help you know when your followers are active on each platform and when you should publish in the future.

How BrightFire Helps Independent Insurance Agents with Social Media

That wraps up our webinar on social media marketing! If you’re ready to set your agency up for social media success, but maybe don’t have the bandwidth to do so, or you’d like to leave it to the digital marketing experts, BrightFire’s Social Media Marketing service is available.

This service aims to take away the burden of constantly coming up with ideas, writing and scheduling social media content for your agency, as well as posting the content to Facebook, Instagram, LinkedIn, and Google Posts. If there’s a social media network you don’t have an account with yet, our experts can set that up for your agency and make sure your new profile is filled out and branded properly to be found more easily by people in your local area.

As part of our Social Media Marketing service, we audit your current profiles and can make updates to profile pictures and cover photos. We can also update the information and configuration of each profile, as well as help rapidly build your audience before we begin posting regular content by sending out an email blast inviting your current policyholders to follow you on social media. These email blasts are available during onboarding and on a quarterly recurring basis. We also provide you with a comprehensive social media dashboard with metrics reporting so you can analyze your performance and make updates to your content strategy.

Since most people who follow you are probably policyholders, we break up the sales-related posts with lighthearted, helpful content that makes sense for any insurance agency. This content track is called General Safety & Preparedness, and we provide 13 of these posts each month. We also provide an optional Diversity & Inclusivity content track that observes nine different heritage months throughout the year.

We also provide three posts each month in each of the following optional insurance categories: personal, business, life, health, group benefits, and Medicare. You simply let us know which content tracks you’d like, and we will take care of the rest. This adds up to a total of 32 posts each month.

Custom campaigns are additional posts outside of the content we create for all of our Social Media Marketing clients. These are generally used to cover advanced topics, like hosting giveaways, publishing customer or staff spotlights, or promoting your commercial clients.

Lastly, for agents who are not as tech savvy but want to better engage with their followers, we can walk you through how to manage your social media accounts, create stories, post videos, and share best practices so you are set up with an effective content strategy.

How to Get Started with BrightFire’s Social Media Marketing Service

If you’re new to BrightFire and would like to take advantage of our services, you can sign up for BrightFire’s Social Media Marketing service for only $95 per month.

You have the option to purchase additional custom campaigns as needed for $75 each, or you can enroll in a recurring subscription if you plan to take advantage of them every month.

Our digital marketing services don’t have any setup fees, contracts, or user fees, and we also include a 30-day money-back guarantee.

Our onboarding process is designed to take the burden off of you as much as possible and consists of one 30-minute phone call. Typically, we can launch our Social Media Marketing service within a week of signing up.

As a thank you for attending today, we’re offering a $50 promo to webinar attendees. You can receive a $50 account credit for signing up for our Social Media Marketing service by next Wednesday, April 3rd.

To get started with BrightFire, please contact sales. On our website, you can submit your purchase, start a live chat with us, or schedule a call with a BrightFire expert.

Q&A Session on Insurance Social Media Success

That concludes our presentation on The 6 P’s of Insurance Social Media Success. Now we’ll head into our Q&A session, if anyone has any questions!

As a reminder to our attendees, we’ll do our best to answer any questions that come through. If we aren’t able to address your question during the webinar, someone from BrightFire will follow up with you via email to answer your question.

How important is it to publish videos?

Great question! Unfortunately, I can’t say for sure what’s right for your individual account. But I can tell you that video typically receives more engagement than photos, and studies have even found that people retain a message they watched on video much more than what they read in a caption. That being said, there are a lot of factors to pay attention to, like the content of your posts, the quality of the photo or video, and even what platform you’re posting it on.

Even on BrightFire’s channels, I’ve seen that our videos often perform better than a graphic that we may post. But often, when we post a photo of a team outing, we see the most engagement. So I recommend giving video a try if you have the capacity for it and analyzing how it performs against your other types of content.

Should I still be on social media if I don’t have time to engage with followers?

Yes, absolutely! As long as you can publish content consistently, whether that be every day or just once a week, your agency should be on social media. Earlier, we talked about the fact that it’s another platform for your potential and current customers to reach out to your agency with questions or contact you to get a quote. And even if you can’t check your messages often, you can set up those auto-responders redirecting people to email or call your agency instead.

But another perk that we didn’t touch on today is the fact that being present on social media and posting content is that it can help your agency improve its Google rankings, since your individual profiles for each platform can populate in the search results. So even if you can’t always get around to engaging with your followers or responding to comments others post on your content, you should absolutely still consider being on social media.

Well, I think that is all the time we have for questions today. Thank you to everyone who submitted a question.

Upcoming Webinars

Our next webinar in May is, “Revealing The Power In BrightFire Website Customers’ Hands.”

While BrightFire prides itself on providing an easy, done-for-you approach to our Insurance Agency Website service, we also know there are independent agents who enjoy being more hands-on and want to leverage all of the website features, sales tools, and support tools that BrightFire has to offer.

In this webinar, we’ll reveal the true power that BrightFire customers have pertaining to customizing their websites and walk you through the various ways you can take your agency website to the next level.

This webinar will be held Thursday, May 30th, at 2 PM Eastern or 11 AM Pacific.

You can reserve your spot at these webinars by visiting the webinars page on our website at brightfire.com/webinars.

So that does it for today! From me and the rest of the BrightFire team, we’d like to thank all of you for attending.