Running an independent insurance agency means wearing multiple hats and managing several responsibilities simultaneously, leaving little time for inefficiencies. That’s why your website should be more than just a digital storefront—it should be a powerful tool that streamlines your workflows, empowers your team, and enhances the customer experience.

In our latest 20 Minute Marketing Webinar, Molly Leonard, BrightFire’s Content Coordinator, explored essential website integrations that save your agency time and help simplify operations. We’ll also discuss how BrightFire’s Insurance Agency Website service provides everything your agency needs to sell more insurance while working smarter, not harder.

Time-Saving Agency Website Integrations

Watch the webinar, read through the full transcript, or jump ahead to the section you’re most interested in to discover time-saving integrations to leverage on your agency website.

- Short Lead Forms

- Comparative Raters

- Customer Service Integrations

- Automated Google Reviews

- Appointment Scheduling

- Webchats

- AMS or CRM Integrations

Watch the Webinar

Additional Questions?

If you have any questions about what we discussed in the webinar or BrightFire’s Insurance Agency Website service, please schedule a personalized consultation with a BrightFire Sales Advisor.

Webinar Transcript

Welcome everyone! My name is Molly Leonard, and I’m a Digital Marketing Expert here at BrightFire, as well as your host for today’s webinar. Thank you all for joining us.

In March, we discussed how your agency can Boost Brand Awareness with BrightFire’s Website Visitor Retargeting & Search Engine Branding. If you missed it or any of our previous webinars in the 20 Minute Marketing Webinar series, you can access the whole series on-demand by visiting brightfire.com/webinars.

Our goal with these webinars is to provide you with digital marketing advice and discuss current digital marketing topics in a brief 20-minute format followed by a Q&A period to answer any questions you may have. If you have questions during the webinar, please use the Q&A feature. We’ll do our best to answer all of the questions that come through; otherwise, we will personally reach out to you afterward.

Today’s webinar topic is Time-Saving Website Integrations Every Independent Agency Should Use. Running an independent insurance agency means wearing multiple hats and managing several responsibilities simultaneously, leaving little time for inefficiencies. That’s why your website should be more than just a digital storefront—it should be a powerful tool that streamlines your workflows, empowers your team, and enhances the customer experience.

So today, we’ll explore essential website integrations that save your agency time and help simplify operations. We’ll also discuss how BrightFire’s Insurance Agency Website service provides everything your agency needs to sell more insurance while working smarter, not harder.

Today’s webinar is being recorded, so everything we discuss will be saved and emailed to you in the next business day or two so you can watch it later on-demand.

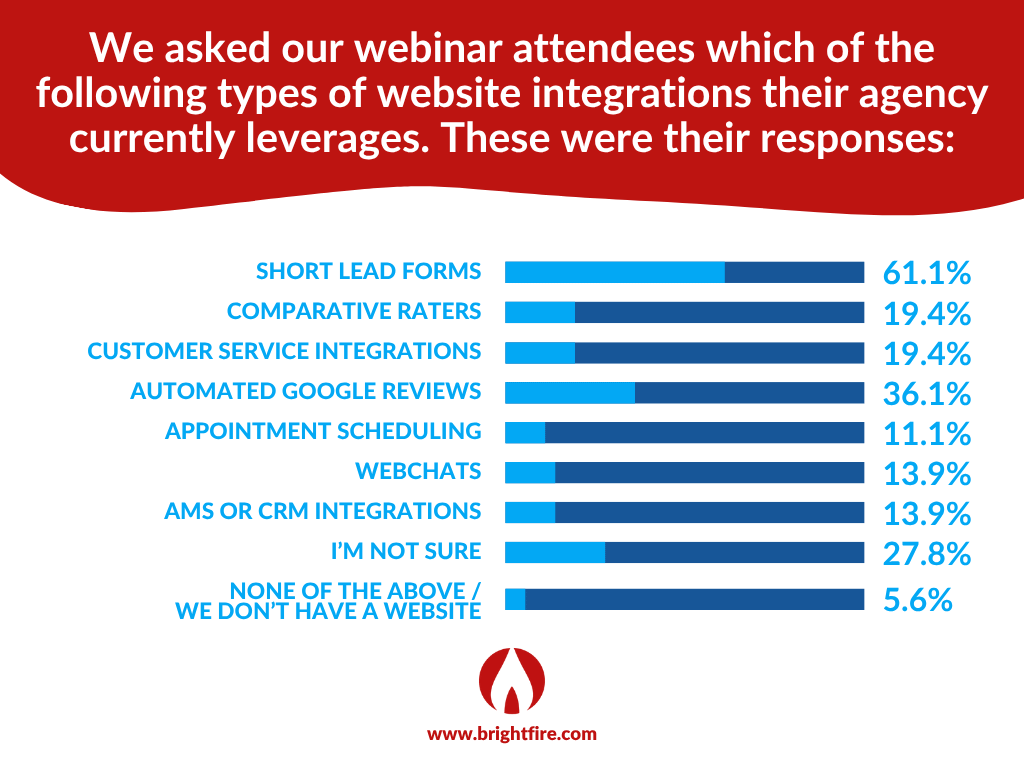

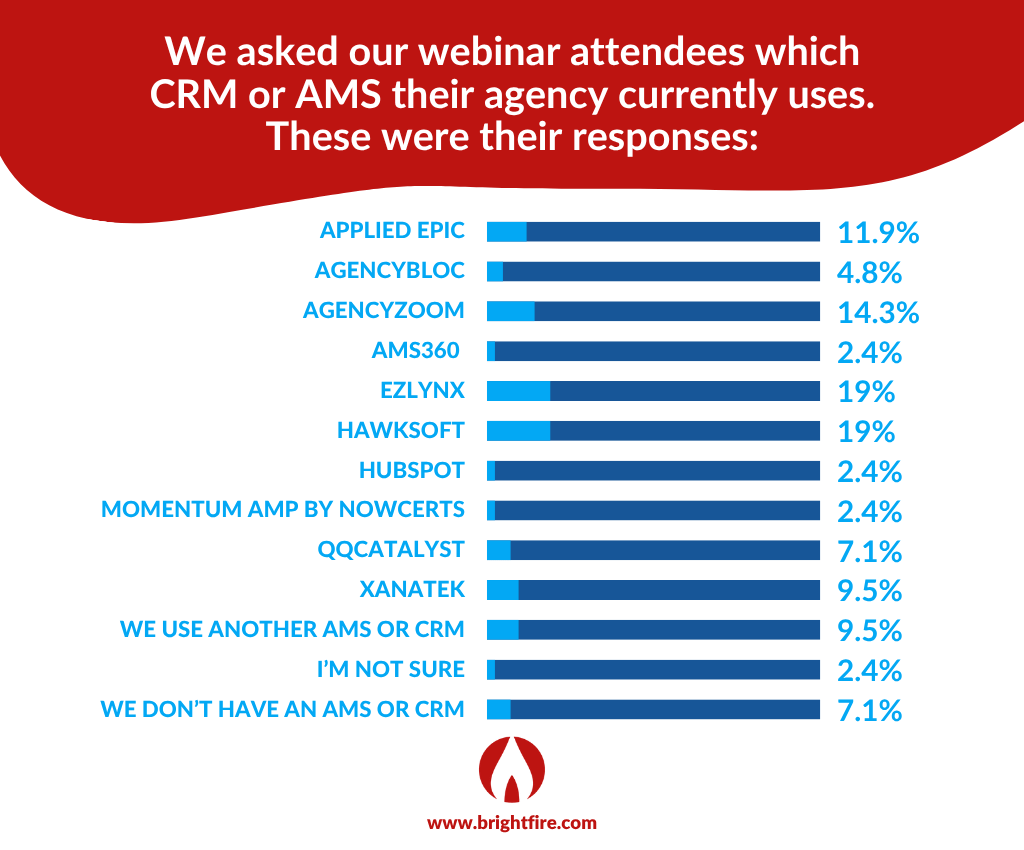

Lastly, we do have a couple of polls for today’s webinar. When launched, you’ll see the poll pop up on your screen with the question and response options. Every poll is anonymous, and I’ll give you roughly 30 seconds to share your response, and then we’ll discuss the results with the group.

About BrightFire

Before we dive into today’s topic, I’d like to share a brief background on BrightFire, since we have a mix of current customers and agents who are new to BrightFire attending today.

So BrightFire began by providing insurance agency websites in 2000. And over the years, as the digital marketing needs of insurance agents grew beyond just agency websites, we added new services, including:

- Search Engine Optimization

- Local Listings Management

- Reviews & Reputation Management

- Search Engine Marketing

- Social Media Marketing

With any of our services, our goal is to really make it as easy as possible for your agency. So everything we do, from onboarding and setup to providing customer support for years to come, has a done-for-you approach that’s focused on taking the burden off of your agency. Our digital marketing experts set up and manage everything for you with all of our services, so you can save time, focus on what you do best, and grow your business.

Currently, we work with over 2,500 agencies across the nation, and our first agency customer in 2000 is still a BrightFire customer today.

With that background on BrightFire, let’s get started.

What’s Ahead

With 74% of consumers shopping for insurance online, 69% running searches before scheduling an appointment, and 25% ultimately purchasing insurance online, it’s vital to leverage various integrations for your agency website to improve your customer experience, increase efficiency, and boost sales (J.D. Power, LSA).

There are seven main types of website integrations to consider in order to help your website work for your agency and streamline your operations, which are short lead forms, comparative raters, multiple customer service integrations, automated reviews, appointment scheduling, webchats, and AMS or CRM integrations.

After we dive into each of these integrations, we’ll also briefly discuss how BrightFire’s Insurance Agency Website service is available to provide your agency with an amazing, custom-designed website that includes any of the integrations we’ve discussed today so you can save time and focus more on following up with your leads and building stronger relationships with your customers.

Short Lead Forms

Starting at the top of our list, short lead forms are a no-brainer in this day and age. Also known as smart quote forms, these forms are designed to simplify a website visitor’s request to receive a quote from your agency and convert more visitors into leads.

As you can see from this study by Merkle, most consumers are willing to share their data in order to create a more personalized experience, so it’s important for your agency to be strategic about where you place short lead forms on your website and how you use them to save time while enhancing the customer experience.

You can have forms linked to multiple integrations for the various lines you sell, such as personal, commercial, and life insurance. From there, you can customize an on-screen confirmation message after a quote form is submitted, or you can redirect leads to another page of your website. You can also create seamless workflows through your CRM or AMS to quickly and efficiently respond to prospects who submitted a form, but we will dive into those specific integrations more in-depth later.

To help encourage website visitors to complete the form and boost your website’s conversion rates, smart quote forms should request as little information as necessary for your agency to appropriately follow up with them, such as their name and email, as well as the type of insurance they’re interested in. You can also include a field for their phone number, but we recommend keeping this field optional, since not everyone feels comfortable giving out that information.

With BrightFire’s short lead forms included in our Insurance Agency Website service, your agency also has the ability to send custom text and/or email notifications to the right agent or group of agents based on the type of quote request. For example, all personal insurance quote requests can go to your personal lines agents, and all commercial insurance quote requests can go to your commercial lines agents.

Comparative Raters

Another time-saving website integration we highly recommend is a comparative rater. Comparative raters allow potential customers to instantly compare quotes from multiple insurance carriers on a single platform at any time of day or night. This integration not only saves your agency time and improves operational efficiencies, but it can also significantly enhance the user experience by saving your visitors time and providing them with a transparent view of pricing options.

BrightFire websites can integrate with just about any consumer-facing comparative rater, including Vertafore PL Rating, Applied Rater, Compulife, EZLynx, AgentSecure, SinglePoint Leads, and bolt access. If you don’t see the quoting tool your agency uses on our list and you’re unsure if we can integrate it with your BrightFire website, please feel free to submit the question through the Q&A feature in Zoom now or reach out to us after the webinar.

Customer Service Integrations

Next, your agency should consider website integrations specifically aimed at improving customer service, since 97% of consumers say customer service is crucial for brand loyalty (Forbes).

Customer service integrations can provide a seamless customer experience for your website visitors while saving your staff time and energy responding to service requests by providing easy access to support, resolving issues quickly, and leveraging customer data across different platforms.

Some examples of customer service website integrations include online billing and payments, online claims filing, certificate of insurance requests, policy change requests, auto ID card requests, annual insurance reviews, and client portals.

Many of these customer service integrations are available through BrightFire’s various technology partners, including GloveBox, Xpress-pay, Applied Systems, ClaimSetter, ClientCircle, hr360, ePayPolicy, Employee Navigator, Insurance Agent App, and Vertafore.

No matter the integrations you leverage to boost the service and experience you offer your prospects and policyholders online, having a customer experience plan in place to provide consistent communication and support throughout the year, instead of only during onboarding and renewal, can establish stronger, more loyal relationships with your policyholders.

Automated Google Reviews

Next up on our list of time-saving website integrations is automated Google reviews. With just over 90% of consumers reading reviews before making a purchase and more than 70% of people directly stating that reviews increase trust, it’s crucial your agency showcases your customer reviews on your website.

By seamlessly integrating your positive Google reviews, you can boost your agency’s social proof and help website visitors feel confident about getting a quote from your agency. That’s because people want to know the experience previous customers had with your business and what they can expect from your agency as a potential policyholder. Featuring your best reviews throughout your website will show that your insurance agency has a long history of success and great service.

Instead of manually adding each new positive review to your website, BrightFire’s automated reviews integration saves your agency time by scanning your Google Business Profile for new reviews every 24 hours and automatically displaying all 4-star and 5-star Google reviews on your website.

To further build consumer trust and credibility, you should integrate more than the review text from Yelp, Google, or Facebook to your website. You should also transfer the name and photo of the reviewer, as well as the name of the third-party review service from which the review was originally posted. Providing this much information about each review on your website helps visitors feel more confident that they are reading authentic reviews that they could find on other review platforms as well.

Appointment Scheduling

Another great website integration to consider is appointment or call scheduling. Statistics show that 34% of appointments are scheduled online after working hours (Signpost), so appointment scheduling integrations can offer a convenient way for customers to pick an open time on your calendar at any time of day.

Not only does this integration prevent your agency from losing potential leads after hours when a staff member isn’t available, but it also saves your agency time, eliminating the need to go back and forth with prospects to find a time that works for both of you to meet. Whichever scheduling service your agency currently uses, such as Acuity Scheduling, Calendly, or Doodle, BrightFire’s integration makes it easy to connect to your BrightFire website.

Other benefits of this integration include setting up the calendar to show only the days, hours, appointment types, and personnel of your choosing, so no one on your team will get overbooked. You can even select how soon in advance appointments can be scheduled to avoid catching any staff members off guard with a newly scheduled meeting on short notice.

Appointment scheduling integrations can also help enhance the overall customer experience by allowing you to send appointment reminders to consumers who have booked an appointment. These reminders can also significantly improve retention rates, since studies show that 20% to 40% of no-shows can be reduced with automated appointment reminders (Backoffice Pro).

Finally, BrightFire’s appointment scheduling integration is supported in the staff section of BrightFire websites, so people can easily see who they are booking an appointment with. It’s also supported by our My Agent Personalization feature, which allows agents to share a unique link to prospects and customers that displays pertinent contact information throughout your website for that individual visitor.

Webchats

Another time-saving website integration your agency should leverage is webchat. According to Tidio, 41% of customers say they prefer real-time customer service via live chat over other methods, such as email or phone support. By offering a webchat on your website, your agency can provide potential customers with a direct, real-time communication channel to receive immediate assistance and ask any questions they may have as they browse your website.

Websites with a live chat feature often improve their user experience, strengthen relationships with prospects and policyholders, and boost conversion rates. According to Zoho, some reports indicate a 20% increase in conversions.

If your agency already uses an online chat platform like Chatra, HubSpot, or Zendesk Chat, it’s easy to install the chat platform’s plugin on your website, connect it to your agency’s account, and activate the chat. BrightFire also offers our own Webchat feature within our Insurance Agency Website service to easily manage all of your messages in one dashboard while better engaging with your prospects and moving them down the sales funnel more easily.

Through BrightFire’s Webchat, your agency can assign conversations to individual staff members or teams of staff members to follow up with visitors, so you save time routing conversations to the appropriate people. You can save even more time leveraging AI to answer visitor questions for you based on the information you provide, generate tailored responses to your website visitors’ messages, or rephrase messages you’ve written.

The best part about live chats is that your agency doesn’t have to be available 24/7. With BrightFire’s Webchat specifically, if none of your agents or CSRs are available to chat with a visitor, they can leave a message that will be sent to your agency’s messaging inbox. The user will also receive a text message confirming that you received their message.

AMS & CRM Integrations

The final time-saving website integration that we will discuss today is one that connects to your customer relationship management or agency management system, which we briefly mentioned at the beginning of today’s presentation.

By integrating your CRM or AMS with your website forms, your agency can enhance workflow efficiencies and provide faster response times to prospects following a form submission. This occurs by automating the transfer of data from a quote request form directly into the platform you use to manage leads. This integration can help eliminate manual data entry, reduce errors, and free up valuable time for your staff to focus on your policyholders and prospects.

With this integration, you can even enhance your customer experience by enabling automatic workflows and sequences within your AMS or CRM that send emails and/or text messages thanking consumers for their requests and initiating the next steps to getting them a quote.

BrightFire websites can integrate directly with AMSes such as Xanatek, Momentum AMP by NowCerts, and AgencyZoom. You can also keep an eye out on our blog and social media channels for upcoming AMS integrations with HawkSoft, AMS360, QQCatalyst, InsuredMine, AgencyBloc, and Applied Epic. BrightFire websites can also integrate with popular CRMs such as HubSpot, Salesforce, and EZLynx through an integration with Zapier.

How BrightFire Helps with Websites

Now, if you’re ready to save your agency time by leveraging the various website integrations we discussed today, but don’t have a custom-designed website by BrightFire yet, our Insurance Agency Website service is available to you.

Our expert website developers and designers provide everything you need in an agency website to attract and convert insurance buyers online, including:

- Custom Designs

- Lead Conversion Optimizations

- Mobile Responsiveness

- Ready-To-Go Insurance Pages

- Search Engine Optimizations

- Sales Tool Suite

- Support Tool Suite

- Featured Reviews

- Monthly Reporting

- Weekly Blog Posts

- Managed Security

You’ll also have the help of our friendly team of digital marketing experts who is here to provide support and answer any questions about your BrightFire website. Most customer-requested changes to the website are included at no cost.

Insurance Agency Websites & Your Overall SEO Strategy

But our support doesn’t stop there. In order to have an effective website that’s working for your agency, your website should also be optimized to rank well in the search engines. That’s where BrightFire’s Ultimate SEO Bundle is available to provide your agency with everything you need to rank in Google.

In addition to getting the benefits we mentioned on the last slide pertaining to our Insurance Agency Website service, our Ultimate SEO Bundle also enrolls your agency in our Reviews & Reputation Management service, since search engine rankings thrive on positive reviews. This service helps your agency consistently generate new reviews, collect client feedback, and protect your online reputation.

And because consistent and accurate information on key search engines is the foundation of local search success, the Ultimate SEO Bundle also includes our Local Listings Management service. This service helps your agency get found across the web on more than 50 of the most important listings so consumers can reach you, with or without visiting your website.

The best part is that when you sign up for the Ultimate SEO Bundle, you’ll save on the standalone prices of each of those three services.

How to Get Started with BrightFire

If you’re new to BrightFire and would like to take advantage of our services, you can sign up for BrightFire’s Insurance Agency Website service for only $140 per month.

If you’re interested in taking advantage of BrightFire’s Ultimate SEO Bundle to cover all of your SEO bases and help your agency attract new insurance buyers, you can do so for just $250 per month. As a reminder, that includes our Insurance Agency Website, Reviews & Reputation Management, and Local Listings Management services, and saves you $40 per month off the standalone prices.

Our digital marketing services don’t have any setup fees, contracts, or user fees, and we also include a 30-day money-back guarantee.

Onboarding typically consists of two 45-minute phone calls and about an hour of your own time to review your website. We’ll work with you until you’re totally happy with your new website.

As a thank you for attending today, we’re offering a $50 promo to webinar attendees. You can receive a $50 account credit for signing up for our Insurance Agency Website or Ultimate SEO Bundle services. This promo ends next Wednesday, June 4th.

To get started and receive your $50 account credit, simply schedule a personalized consultation with a BrightFire Sales Advisor at brightfire.com/contact-sales and mention your webinar attendance.

Q&A Session on Agency Website Integrations

That concludes our presentation on Time-Saving Website Integrations Every Independent Agency Should Use. Now we’ll head into our Q&A session, if anyone has any questions!

As a reminder to our attendees, we’ll do our best to answer any questions that come through. If we aren’t able to address your question during the webinar, someone from BrightFire will follow up with you via email to answer your question.

“Is there an additional cost to add these integrations to a BrightFire website?”

Great question! All of the website integrations we discussed today are included in our Insurance Agency Website service at no additional cost. As long as you already have an account or subscription to one of the platforms we integrate with, we can connect it to your BrightFire website. Even BrightFire’s own Webchat feature is available to our website customers at no additional cost.

“What’s the most important website integration to implement if we’re just getting started?”

Another good question! This one is a little more complex and will depend on your agency’s goals and the various digital tools you’re already using, such as an appointment scheduling tool, AMS, or comparative rater.

Obviously, short lead forms will be crucial to capturing leads for your agency. And while an AMS or CRM integration will streamline the process of following up with your form submission leads, that could come later. But it will help your team tremendously.

Another one that would be very beneficial for your team, even if you’re just starting out, would be appointment scheduling. That integration will really help your website work for your agency by allowing consumers to set up appointments with your team, even outside of business hours. But like I mentioned, when you start the website onboarding process with BrightFire, our team can help you decide which integrations make the most sense for your agency.

Well, I think that is all the time we have for questions today. Thank you to everyone who submitted a question.

Upcoming 20 Minute Marketing Webinars

Our next webinar in July is, “How to Eliminate Duplicate Listings To Strengthen Your SEO & Online Reputation.”

Managing your online presence across the web, as an independent insurance agency, can be overwhelming, especially if you have duplicate local business listings that are hurting your online reputation and visibility in the search engines.

In this webinar, we’ll break down how duplicate listings occur, the negative impact they have on your online presence and rankings, and practical tips to find and eliminate them across major listings platforms. We’ll also discuss how BrightFire’s Local Listings Management service helps you take control of your agency’s online presence across the web so you can build consumer trust and boost your website’s SEO rankings.

This webinar will be held Thursday, July 31st, at 2 PM Eastern or 11 AM Pacific.

You can reserve your spot at these webinars by visiting the webinars page on our website at brightfire.com/webinars.

So that does it for today! From me and the rest of the BrightFire team, we’d like to thank all of you for attending.